When it comes to self-billed e-invoices for imported services, businesses must understand the correct procedure to ensure tax compliance and smooth operations. This article outlines the critical steps and best practices for managing self-billed e-invoices for imported services, ensuring your business remains compliant with Malaysia’s tax regulations.

1. What is a Self-Billed e-Invoice for Imported Services?

A self-billed e-invoice for imported services refers to the process in which the business receiving imported services generates its own e-invoice instead of relying on the foreign supplier to issue it. This process ensures that the business correctly accounts for the imported service for tax purposes.

For a detailed guide on issuing a self-billed e-invoice, read our article on How to Issue a Self-Billed e-invoice via MyInvois Portal: A Step-by-Step Guide for Malaysians.

2. Why is Self-Billed e-Invoice Important for Imported Services?

The self-billed e-invoice system is vital for businesses importing services because it ensures that the correct tax is applied and that the business meets its VAT obligations under Malaysian regulations. The self-billed e-invoice helps businesses report the service transactions and pay the necessary tax like Withholding Tax , ensuring compliance with Malaysian tax law.

3. Key Steps for Malaysia Businesses to Open a Self-Billed e-Invoice for Imported Services

For businesses that import services from abroad, the process of opening a self-billed e-invoice follows two main scenarios:

i) After Payment to the Supplier

If payment is made to the supplier, the business is required to issue a self-billed e-invoice before the end of the following month.

ii) Upon Receiving the Supplier’s Invoice

Alternatively, if the business receives an invoice from the supplier, the self-billed e-invoice should be generated before the end of the following month as well.

Example:

- Scenario 1: If you make a payment to a foreign supplier for an imported service, and the payment is made on September 15th, the self-billed e-invoice must be generated by October 30th.

- Scenario 2: If you receive the supplier’s invoice on September 25th, the self-billed e-invoice must be generated by October 30th.

This ensures that the transaction is properly documented and tax obligations are met.

4. Withholding Tax Considerations for Imported Services

When dealing with self-billed e-invoices for imported services, businesses must also pay attention to Withholding Tax . If the business is using services like Facebook ads, Google Ads, or Instagram ads, it may be required to pay Withholding Tax on the amount billed. Here’s how to handle it:

- WHT Calculation: Businesses must calculate WHT based on the amount paid for the service.

Example:

- If you pay RM600 for Facebook ads, the WHT would be calculated as RM600 x 8% = RM48.

- If you pay RM600 for Facebook ads, the WHT would be calculated as RM600 x 8% = RM48.

- Penalties for Non-Compliance: If the Withholding Tax is not paid on time, there may be a 10% penalty for failure to comply. This also means the tax on advertising costs cannot be deducted.

5. How to Pay Withholding Tax for Imported Services

Businesses should make WHT payments through Malaysia’s MyTax system under e-WHT. To calculate and make the Withholding Tax payment:

- Log into MyTax and access the e-WHT section.

- Fill out the CP37 form, generate the Bill Number, and proceed with the payment via ByrHasil.

It is crucial to ensure that the WHT is paid within 30 days from the payment date to avoid any penalties or issues with self-billed e-invoice compliance.

6. Frequency of Withholding Tax Payments

If your business incurs Withholding Tax payments that are below RM500, you may choose to make the payments every six months instead of monthly. The timeline for this is:

- For services paid between June 1 and November 30, Withholding Tax should be paid on or before December 30.

- For services paid between December 1 and May 31, Withholding Tax should be paid on or before June 30.

This flexibility allows businesses to manage smaller tax obligations with more ease.

7. Conclusion: Managing Self-Billed e-Invoices for Imported Services in 2025/2026

Understanding the self-billed e-invoice process is essential for businesses that import services. By generating self-billed e-invoices, businesses ensure compliance with Malaysia’s e-invoicing requirements while avoiding issues with tax authorities. Additionally, proper management of Withholding Tax ensures smooth financial operations and avoids penalties.

By following the correct steps for self-billed e-invoicing and Withholding Tax payments, businesses can ensure smooth transactions with international service providers while maintaining full compliance with local tax regulations.

Need Help to Implement e-invoice Seamlessly? Explore the Best e-invoicing Software Malaysia – JomeInvoice

JomeInvoice: Best e-invoicing Software Malaysia

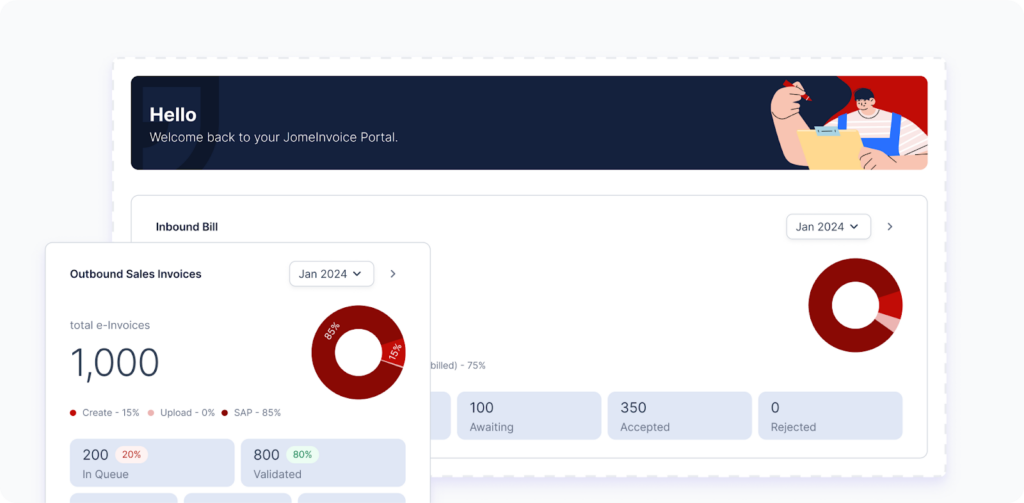

When it comes to integrating best e-invoicing software solutions for both small and large enterprise Malaysia, JomeInvoice has quickly become a standout choice, positioning itself among the top middleware as e-invoicing platforms in the country. With its user-friendly features and robust e-invoice system compatibility, it’s no surprise why many businesses are turning to JomeInvoice for a seamless transition to the LHDN e-invoice compliance.

Why JomeInvoice is the Best e-invoicing Software Provider for SMEs and Large Enterprise Malaysia:

JomeInvoice stands out as the most user-friendly and comprehensive e-invoicing software solution, offering the perfect balance of flexibility, compliance, and support for both SMEs and large enterprise Malaysia. Whether you are transitioning into the LHDN e-invoicing mandate or looking to streamline your current invoicing process, JomeInvoice provides everything you need—from free trials to ongoing updates and local support.

- Flexible System Compatibility

JomeInvoice offers seamless integration with popular systems such as SAP ECC6, S4 Hana, Sage300, MS365, Netsuite, Odoo, Xero & etc. This flexibility makes it ideal for businesses of all sizes—whether you’re an SME or a large enterprise Malaysia, JomeInvoice adapts to your current operations without a hitch. - Full Compliance with LHDN e-invoicing Regulations

Compliance is key, and JomeInvoice ensures that your business meets all LHDN e-invoicing guidelines. ISO-certified and fully PDPA-compliant, JomeInvoice offers a secure, worry-free invoicing process that keeps you aligned with Malaysia’s regulatory standards. - Trusted by Leading Businesses

Over 60+ major companies, including those in Phase 1 of Malaysia e-invoicing compliance, rely on JomeInvoice for their invoicing needs. The platform is proven to handle large-scale, complex transactions seamlessly, making it a trusted choice across industries. - Free Upgrades, Training, and Dedicated Support

JomeInvoice keeps your business up to date with automatic upgrades that maintain LHDN compliance. Plus, free training and access to a dedicated Malaysian support team ensure your staff can easily adapt to the platform. With cloud server capabilities, you’ll also benefit from secure, flexible invoicing solutions. - Backed by a Listed Company

JomeInvoice is not just reliable but also backed by a publicly listed company on Bursa Malaysia. This adds an extra layer of trust and assurance for businesses looking to invest in long-term solutions.

Ready to streamline your e-invoicing processes?

Contact JomeInvoice today and take advantage of the comprehensive e-invoicing software features! Our dedicated team is ready to help your business stay ahead with compliance and efficiency.

Contact JomeInvoice Sdn Bhd:

- Address:

Level 38, MYEG Tower, Empire City Damansara, Jalan PJU 8, Damansara Perdana, 47820 Petaling Jaya, Selangor

D-04-07, Plaza Bukit Jalil (Aurora Place), No. 1, Persiaran Jalil 1, Bandar Bukit Jalil, 57000 Kuala Lumpur - Phone: +6016-732 0163

- Social Media:

LinkedIn | Facebook

Don’t wait—schedule a free e-invoice service consultation today and see why JomeInvoice is the top choice for businesses nationwide!

Read More on e-invoicing Malaysia Latest Updates

When Must New Businesses Exceeding RM500k in Revenue in 2023–2025 Start E-invoicing in Malaysia