Summary

So what happened?

On January 5, 2026, Prime Minister Datuk Seri Anwar Ibrahim announced a significant extension to Malaysia’s Phase 4 e-invoicing timeline, creating both relief and confusion among small and medium enterprises (SMEs). If your business has annual revenue between RM1 million and RM5 million, this announcement directly affects you—but perhaps not in the way you think.

This guide clarifies what the e-invoice delay actually means, corrects common misconceptions, and outlines the strategic actions SMEs should take in 2026 to avoid last-minute implementation chaos.

Understanding the Phase 4 e-Invoice Extension

What Changed (and What Didn’t)

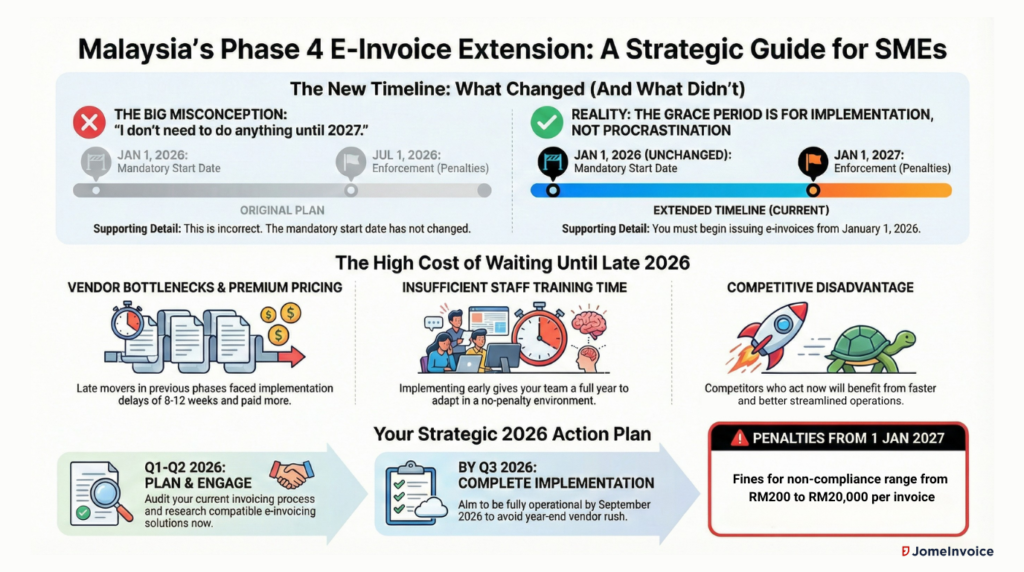

The government extended the enforcement deadline for Phase 4 e-invoicing from July 1, 2026 to January 1, 2027. This means the grace period—during which businesses can implement e-invoicing without facing penalties—has been doubled from six months to a full 12 months throughout 2026.

However, here’s the critical detail many businesses are missing: The mandatory start date remains January 1, 2026. Phase 4 businesses should already be issuing e-invoices. What was extended is only the penalty-free period, not the compliance requirement itself.

| Timeline Element | Original Plan | Extended Timeline |

| Mandatory Start Date | January 1, 2026 | January 1, 2026 (unchanged) |

| Grace Period Duration | 6 months | 12 months |

| Enforcement Start (Penalties Begin) | July 1, 2026 | January 1, 2027 |

Why the Government Extended the Deadline

According to official statements, the extension addresses two primary concerns: the high cost of implementation for SMEs and limited business readiness across the sector. This follows the December 2025 decision to raise the exemption threshold from RM500,000 to RM1 million, effectively eliminating the previously planned “Phase 5” and exempting Malaysia’s smallest businesses entirely.

The extension reflects the government’s recognition that SMEs require additional time to prepare—but it does not signal a retreat from the e-invoicing mandate itself.

The Most Dangerous Misconception About the e-Invoice Delay

Many SME owners are interpreting the extension as “I don’t need to do anything until 2027.” This is incorrect and potentially costly.

The reality: You should be issuing LHDN-compliant e-invoices starting January 1, 2026. The 12-month grace period means you won’t face penalties if you’re still working on full compliance, but it doesn’t mean you have permission to delay implementation indefinitely.

Think of it this way: the grace period is a buffer for businesses actively implementing e-invoicing systems, not a pass to postpone planning until Q4 2026.

Why Waiting Until Late 2026 is Risky for SMEs

While the extended grace period provides breathing room, delaying implementation until the second half of 2026 creates several significant risks:

Vendor Capacity Bottlenecks

E-invoicing implementation typically requires 3-6 weeks from consultation to go-live. If thousands of Phase 4 businesses wait until October or November 2026, vendor capacity will be overwhelmed. Based on patterns from Phase 3, late movers faced implementation delays of 8-12 weeks and paid premium pricing for rush services.

Limited Staff Training Time

Your finance and operations teams need time to adapt to new workflows. The first 30-60 days involve learning curves, workflow optimization, and troubleshooting edge cases. Implementing early in 2026 gives your team a full year to stabilize processes in a no-penalty environment.

System Integration Complexity

Most SMEs use existing accounting software (AutoCount, SQL, Xero) or POS systems that require integration with e-invoicing middleware. Discovering integration issues in December 2026 leaves no buffer for problem-solving before enforcement begins in January 2027.

Competitive Disadvantage

Businesses that implement e-invoicing early benefit from faster payment processing (validated e-invoices reduce payment delays by 2-5 days on average), improved customer trust, and streamlined record-keeping. Waiting means your competitors gain these operational advantages while you’re still using manual processes.

Myth: Will the Government Cancel e-Invoicing Altogether?

Some business owners are hoping the government will reverse the e-invoicing mandate entirely. While understandable, this expectation is unrealistic for several reasons:

First, LHDN has invested significant amount in MyInvois infrastructure. Governments rarely abandon investments of this scale.

Second, Malaysia’s e-invoicing mandate aligns with international tax digitalization standards. Reversing course would damage Malaysia’s credibility in global tax cooperation frameworks.

Third, Phases 1-3 are already operational, with thousands of large enterprises successfully issuing e-invoices. Reversing the mandate now would create administrative chaos for compliant businesses.

Fourth, every previous phase has proceeded as scheduled, with grace periods extended but mandates maintained. Phase 1 launched in August 2024, Phase 2 in January 2025, and Phase 3 in July 2025—all as planned.

The pattern is clear: timelines may flex, but the mandate doesn’t.

Strategic Advantages of Implementing e-Invoicing Now

Rather than viewing e-invoicing as a compliance burden, forward-thinking SMEs are recognizing operational benefits that justify early implementation:

Faster Payment Collection

LHDN-validated e-invoices are processed faster by buyers’ accounts payable systems, reducing average payment cycles. For SMEs managing cash flow carefully, this acceleration matters.

Reduced Administrative Burden

Once integrated, e-invoicing middleware automates Tax Identification Number (TIN) verification, invoice formatting, and submission to the MyInvois portal—eliminating manual data entry and reducing error rates.

Future-Proof Infrastructure

Malaysia’s digitalization of business processes will continue beyond e-invoicing. Businesses that build digital infrastructure now position themselves for future regulatory requirements and operational efficiencies.

Vendor Availability and Standard Pricing

Implementing in Q1 or Q2 2026 guarantees access to vendor support at standard pricing, without the rush premiums and implementation delays that will characterize Q4 2026.

e-Invoicing for SMEs: Choosing the Right Implementation Approach

Phase 4 businesses have three primary options for achieving compliance:

Option 1: Direct Integration with MyInvois

Connecting your existing accounting system directly to LHDN’s MyInvois portal. This requires in-house IT expertise and ongoing maintenance as regulations evolve.

Best for: SMEs with dedicated IT teams and custom-built accounting systems.

Option 2: Full Accounting Software Replacement

Switching to comprehensive accounting platforms with built-in e-invoicing capabilities. This involves significant change management and staff retraining.

Best for: Businesses planning complete digital transformation of finance operations.

Option 3: Middleware Solutions

Using specialized e-invoicing middleware that connects your existing systems (ERP, POS, e-Commerce, Accounting software) to MyInvois without replacing them. This approach minimizes disruption while ensuring compliance.

Best for: Most Phase 4 SMEs seeking fast, cost-effective implementation. Learn more about e-invoicing for SMEs.

Your 2026 Action Plan: What to Do Now

For SMEs Starting Implementation (Q1-Q2 2026)

Step 1: Audit your current invoicing workflow and identify integration requirements.

Step 2: Research e-invoicing solutions compatible with your existing accounting software or POS system.

Step 3: Calculate total implementation costs, including software, integration, and staff training.

Step 4: Schedule implementation during a low-activity period to minimize operational disruption.

Step 5: Allocate 30-60 days for staff training and system stabilization.

For SMEs Still Evaluating (Q2-Q3 2026)

Step 1: Book consultations with 2-3 e-invoicing vendors to compare solutions and pricing.

Step 2: Request implementation timelines to ensure completion before Q4 vendor bottlenecks.

Step 3: Identify internal champion (finance manager or operations lead) to oversee the project.

Step 4: Develop contingency budget for unexpected integration requirements.

Critical Deadline: Q3 2026

To avoid implementation delays and ensure your team is fully trained before enforcement begins January 1, 2027, aim to complete implementation by September 2026 at the latest.

Common Questions About the Phase 4 e-Invoice Extension

Q: If penalties don’t start until 2027, why should I implement now?

Early implementation provides 12 months to stabilize processes, train staff, and troubleshoot issues in a no-penalty environment. Waiting until late 2026 compresses this learning curve into weeks instead of months.

Q: What are the penalties if I miss the January 2027 deadline?

Non-compliant invoices incur fines between RM200 and RM20,000 per invoice, plus potential imprisonment up to six months under Section 120(1)(d) of the Income Tax Act 1967.

Q: Can I issue consolidated monthly e-invoices during the grace period?

Yes, during the 12-month grace period (2026), businesses may issue consolidated monthly e-invoices rather than transaction-level invoices. This flexibility ends December 31, 2026.

Q: Does the extension apply to B2C transactions?

E-invoicing is primarily mandatory for B2B transactions. B2C e-invoicing remains optional unless requested by the buyer.

Take Action: Secure Your Implementation Slot

The extended timeline provides valuable breathing room—but only if you use it strategically. SMEs that implement e-invoicing in early 2026 will enter 2027 with compliant systems, trained teams, and operational advantages over competitors still scrambling to meet deadlines.

Don’t let the grace period extension create a false sense of security. The businesses that thrive in Malaysia’s digital economy will be those that plan for reality, not hope for delays.

Ready to start your e-invoicing implementation? Book a free consultation to discuss your business requirements and receive a customized implementation timeline. Our team specializes in helping Phase 4 SMEs achieve compliance without disrupting existing operations.

Read More on e-invoicing Malaysia Latest Updates

How Exactly LHDN Uses e-Invoice to Detect Tax Avoidance in Malaysia [2025/2026]

Step-by-Step Guide to Issuing a Self-Billed e-Invoice for Taobao Shipping to Malaysia [2025/2026]