e-Invoicing Malaysia: Latest Update in July 2025

Malaysia is moving toward full e-Invoicing adoption by 2027 as part of its digital tax transformation. This comprehensive guide explains what e-Invoice Malaysia is, the latest LHDN implementation timeline, submission models (MyInvois Portal, API integration, middleware), compliance requirements, and how businesses can prepare for smooth implementation across B2B, B2C, B2G, and cross-border transactions.

Malaysia is steadily progressing toward a fully digital economy by 2027, with e-invoicing playing a central role in this transformation. The Inland Revenue Board of Malaysia (LHDN) has mandated the implementation of e-invoicing as part of its modernization efforts to streamline tax administration and enhance business transparency. This initiative will replace traditional paper-based invoices with electronic invoices, which are standardized, validated, and securely transmitted through approved systems.

For businesses in Malaysia, understanding and preparing for e-invoice implementation is essential to ensure compliance with government regulations, avoid penalties, and benefit from more efficient invoicing processes. The shift to e-invoicing is expected to reduce errors associated with manual invoice handling, improve overall operational efficiency, and facilitate easier tax reporting.

This comprehensive guide aims to provide businesses of all sizes—from small and medium enterprises (SMEs) to large corporations—with clear, practical information on e-invoicing in Malaysia. It covers the e-invoice guideline set by LHDN, the implementation timeline, different models of e-invoicing, and how companies can integrate these systems into their existing workflows.

What is e-invoice Malaysia?

An e-Invoice is a digital, structured record of a commercial transaction between a supplier and a buyer, replacing traditional paper invoices or other electronic formats like credit and debit notes. It acts as a precise digital representation of the transaction, containing crucial details such as supplier and buyer information, descriptions of goods or services, quantities, prices, taxes, and the total amount due.

Features of an e-Invoice Malaysia include:

-

- Structured Format: Typically in XML or JSON, allowing seamless data processing.

-

- Complete Transaction Data: Ensures accurate record-keeping and compliance with regulations.

-

- Real-Time Submission: e-Invoices are transmitted to LHDN for near real-time reporting, ensuring up-to-date financial records.

-

- Applicable to All Transactions: This includes Business-to-Business (B2B), Business-to-Consumer (B2C), and Business-to-Government (B2G).

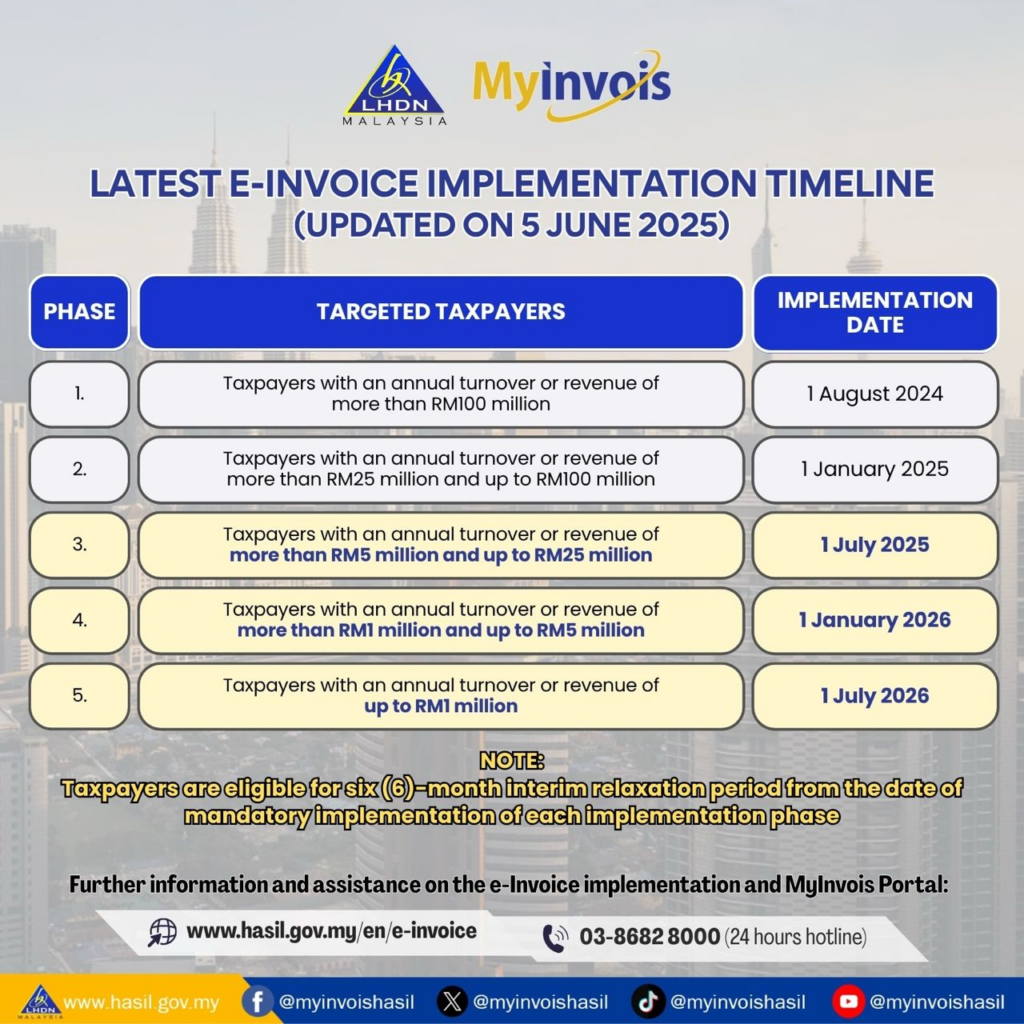

e-Invoice Implementation Timeline

The implementation of e-Invoice will be carried out in phases based on revenue thresholds, allowing businesses sufficient time to transition smoothly to the new system. The updated implementation timeline is as follows:

Note: Based on the https://www.hasil.gov.my/, the Latest e-lnvoice Implementation Timeline.

-

- Phase 1: For taxpayers with an annual turnover of more than RM100 million. Implementation starts on 1 August 2024.

-

- Phase 2: For taxpayers with an annual turnover between RM25 million and RM100 million. Implementation starts on 1 January 2025.

-

- Phase 3: For taxpayers with an annual turnover between RM5 million and RM25 million. Implementation starts on 1 July 2025.

-

- Phase 4: For taxpayers with an annual turnover between RM1 million and RM5 million. Implementation starts on 1 January 2026.

-

- Phase 5: For taxpayers with an annual turnover of up to RM1 million. Implementation starts on 1 July 2026.

MSME Implementation Phases: A six-month grace period is provided for MSMEs (Micro, Small, and Medium Enterprises) before mandatory implementation starts, offering time to adjust and consolidate transactions into monthly e-invoices.

Note: e-Invoice regulations may change. This article reflects information available at the time of publication. For the latest updates and timelines, refer to our Latest e-Invoice Updates page.

When Should a Company Start Using e-Invoice Malaysia?

For companies established in 2022, the timeline for implementing e-invoices depends on their annual revenue and whether they meet specific thresholds set by the Malaysian government.

For Companies Established in 2022:

-

- Revenue Below RM500,000: If the company’s annual turnover is less than RM500,000, it is exempt from implementing e-invoices until it exceeds this threshold. Once the revenue exceeds RM500,000, the company must start e-invoicing from 1 January in the second year following the year it surpasses the RM500,000 threshold.

-

- Revenue Above RM500,000: If the company has annual revenue of at least RM500,000 in its first year (2022), it will need to implement e-invoices starting from 1 January in the second year after reaching RM500,000.

For Companies Established Before 2022:

-

- Companies established before 2022 follow a similar logic, with their implementation date determined by the revenue recorded for the 2022 financial year or the most recent fiscal year.

For more information regarding the Implementation of e-Invoice Malaysia. Get access to the latest e-Invoice Guideline update here.

e-Invoicing Models and Systems in Malaysia

Businesses in Malaysia can adopt various models for e-invoicing:

-

- MyInvois Portal: This is a government-provided platform for businesses with simpler invoicing needs. It enables enterprises to manually create and submit their e-invoices to LHDN. Read more here about MyInvois Portal.

Image from https://mytax.hasil.gov.my/

-

- Direct API Integration: This model is for businesses with more complex needs, allowing for seamless integration between a company’s internal systems (e.g., ERP or accounting software) and LHDN’s MyInvois system. Read more about POS system e invoice.

LHDN sandbox environment API testing

-

- Middleware Solutions: These third-party platforms, like JomeInvoice, facilitate e-invoice integration without significant changes to a company’s existing systems.

e-Invoicing Malaysia Process Overview

The e-invoicing Malaysia process depends on the chosen model (e.g., API integration or the MyInvois Portal) and whether the transaction is B2B or B2C. Here is a general process overview:

e-Invoicing Process for B2B Transactions:

-

- Creation & Submission: The supplier creates an e-Invoice (XML/JSON format) via the MyInvois Portal or ERP system, then submits it to IRBM for validation.

-

- Validation: IRBM checks the e-Invoice for accuracy. If correct, it gets a unique ID and is marked validated. If there are errors, the supplier must correct and resubmit.

-

- Notification: Both the supplier and buyer are notified of the validation status.

-

- Sharing the e-Invoice: The validated e-Invoice, with a QR code for verification, is shared with the buyer.

-

- Rejection or Cancellation: The buyer can request a rejection within 72 hours if there are issues. If accepted, the supplier cancels the invoice; if not, a new e-Invoice is issued.

-

- Storing: The validated e-Invoices are stored by IRBM for access by both parties.

e-Invoicing Process for B2C Transactions:

-

- Creation & Submission: Suppliers create and submit e-Invoices (via MyInvois Portal or manually) to IRBM.

-

- Validation: The e-Invoice is validated, and the buyer is notified of the unique ID.

-

- Notification: The supplier shares the validated e-Invoice or its visual version with the buyer.

-

- Rejection or Cancellation: The buyer can reject the e-Invoice within 72 hours if there are errors, and corrections are made in a new e-Invoice.

-

- Storing: All validated e-Invoices are stored by IRBM for future access.

Who Must Comply with e-Invoicing in Malaysia?

e-Invoicing is mandatory for all commercial activities in Malaysia, covering both domestic and international transactions. However, the roll-out is done in phases based on the annual turnover of businesses.

-

- Mandatory for All Commercial Activities: Regardless of business size or industry, all businesses involved in commercial transactions must comply.

-

- Exemptions for Small Businesses: Businesses with an annual revenue below RM500,000 are exempt from e-invoicing, although this exemption does not apply if the business is a subsidiary of a larger company with higher revenue.

-

- Mandatory Compliance from 1 July 2025: By 1 July 2025, e-invoicing will be compulsory for all taxpayers in Malaysia.

Exemptions and Special Considerations for Certain Transactions

In certain cases, e-invoicing may not be required, or specific guidelines apply for certain types of transactions:

-

- Refundable Vouchers: No e-invoice is required for refundable vouchers, but for non-refundable vouchers, an e-invoice must be issued.

-

- Intercompany Transactions: E-invoices are required for intercompany charges, but no e-invoice is required for inter-department or inter-division transactions within the same company.

e-Invoice Malaysia for MSMEs and Exemptions

MSMEs (Micro, Small, and Medium Enterprises) with an annual turnover of RM500,000 or below are generally exempt from e-invoicing. However, there are exceptions:

-

- MSMEs with corporate shareholders or subsidiaries of a company exceeding the RM500,000 threshold will still need to comply.

-

- If an MSME surpasses the RM500,000 threshold in subsequent years, it will be required to adopt e-invoicing starting from the second year following the fiscal year it exceeds the threshold.

Role of Government Entities in e-Invoicing

Government entities, local authorities, and statutory bodies must also comply with e-invoicing regulations. For transactions with these entities, businesses are required to use a general TIN (“EI00000000040”) for government-related transactions.

Image credit: Facebook page atm house

Consequences of Non-Compliance

Failure to comply with e-invoicing regulations may result in penalties, including fines ranging from RM200 to RM20,000 and/or imprisonment of up to 6 months. Ensuring the timely submission of e-invoices is crucial for avoiding these legal consequences.

Security and Data Privacy in e-Invoicing Malaysia

The LHDN and JomeInvoice ensure that e-invoices are transmitted securely, using robust encryption and data protection measures. Businesses must ensure compliance with data protection regulations and use secure systems to protect sensitive business information during the e-invoice submission process.

Image Credit: IRIS Business services.

Transition Period and Handling Manual Invoices to e-Invoice Malaysia

During the transitional period, businesses can submit either traditional paper invoices or validated e-invoices. This grace period provides businesses with the flexibility to adjust to the new system before full compliance becomes mandatory.

E-invoicing is being implemented in phases, with a six-month interim relaxation period for each phase to help businesses adjust. During this period, businesses can use consolidated e-invoices and will not face prosecution for non-compliance, as long as they meet the requirements for consolidated e-invoices.

Impact of e-Invoice Malaysia on Cross-Border Transactions

E-invoice Malaysia applies to both domestic and international transactions. The Malaysian government has made e-invoicing mandatory for all taxpayers, covering transactions between businesses (B2B), businesses and consumers (B2C), businesses and the government (B2G), as well as cross-border transactions.

E-invoicing is required for both domestic and international transactions. Businesses involved in international trade must comply with e-invoicing rules for both imports and exports. This includes self-billed e-invoices for goods imported into Malaysia and e-invoices for goods exported from Malaysia.

Domestic Transactions:

E-invoicing is mandatory for all types of business transactions within Malaysia, including B2B, B2C, and B2G scenarios.

International Transactions:

E-invoicing also applies to transactions with parties outside Malaysia. For instance, if a Malaysian business sells goods or services to a foreign buyer, it must generate an e-invoice for the transaction. Similarly, if a Malaysian business purchases goods or services from an international supplier, it must issue a self-billed e-invoice to document the expense.

Customization and Integration with Existing ERP Systems

Businesses with existing ERP or accounting systems can integrate e-invoicing using middleware solutions like JomeInvoice, allowing seamless integration with LHDN’s e-invoice system. This reduces disruptions to existing workflows while ensuring compliance.

Simplify Your e-Invoice Malaysia with Jomeinvoice

Easily create, Track, and manage all your e-invoices with Jomeinvoice’s seamless solution.

Industry-Specific Considerations and FAQs from IRBM

Different industries may have specific requirements for e-invoicing. For example:

-

- Retail: Integration with Point of Sale (POS) systems for real-time invoicing.

-

- Manufacturing: Handling complex invoicing scenarios with multiple products or services.

-

- Services: Managing recurring billing and subscription-based invoicing.

Other industries, including healthcare, education, and logistics, are also expected to integrate e-invoicing systems for enhanced compliance.

For more information regarding the Implementation of e-Invoice Malaysia. Get access to the Frequently Asked Questions (FAQs) update here.

How Professional Services Can Help Malaysian SMEs

Professional services can assist SMEs by:

-

- System Integration: Ensuring a seamless connection between existing systems and the e-invoicing platform.

-

- Compliance Assurance: Guiding to ensure adherence to LHDN regulations.

-

- Training and Support: Offering the necessary training for staff to operate the new system effectively.

Frequently Asked Questions (General)

-

- Do I need to change my existing system to use e-invoicing?

Not necessarily. JomeInvoice’s middleware solution integrates with existing systems, making the transition seamless.

- Do I need to change my existing system to use e-invoicing?

-

- Is e-invoicing mandatory for all businesses?

Yes, all businesses involved in commercial activities are required to comply with e-invoicing regulations.

- Is e-invoicing mandatory for all businesses?

-

- What support does JomeInvoice provide?

JomeInvoice offers integration support, training, and ongoing assistance to ensure smooth e-invoicing adoption.

- What support does JomeInvoice provide?

-

- What is the best e-invoicing solution for businesses in Malaysia?

JomeInvoice provides a comprehensive platform that supports both API integration and manual entry, making it suitable for businesses of all sizes.

- What is the best e-invoicing solution for businesses in Malaysia?

-

- How secure is the e-invoicing process in Malaysia?

The LHDN and JomeInvoice employ strong encryption and secure data transmission to protect sensitive business information.

- How secure is the e-invoicing process in Malaysia?

-

- Can I cancel or amend an e-invoice after submission to LHDN?

Yes, businesses can cancel or amend an e-invoice within 72 hours after submission, subject to valid reasons.

- Can I cancel or amend an e-invoice after submission to LHDN?

-

- What penalties apply if a business fails to issue an e-invoice?

Failure to comply may result in fines or imprisonment, with penalties ranging from RM200 to RM20,000 and/or up to 6 months of imprisonment.

- What penalties apply if a business fails to issue an e-invoice?

Conclusion: e-Invoice Malaysia Guideline Implementation 2025/2026

Adopting e-invoicing in Malaysia is crucial for businesses to comply with LHDN regulations and improve operational efficiency. JomeInvoice offers flexible solutions that simplify the transition to e-invoicing. Whether you’re a small enterprise or a large corporation, we can help you meet compliance requirements and streamline your invoicing processes.

By following the guidelines and adopting the latest e-invoicing systems, businesses can remain compliant while benefiting from streamlined processes and improved tax administration.

Why Choose JomeInvoice? Malaysia #1 Comprehensive e-invoice Software for Retail POS System Integration

As Malaysia approaches the 2025/2026 deadline for mandatory e-invoicing compliance, retail businesses must modernize their processes to stay ahead. But for many, integrating existing retail POS systems with e-invoice software—especially across sales, purchasing, and self-billing—remains a significant challenge.

This is where JomeInvoice steps in.

Proudly developed in Malaysia, JomeInvoice is the first comprehensive middleware solution purpose-built to unify disconnected systems and enable seamless, end-to-end e-invoice software for retail POS system integration.

🔄 JomeInvoice: Bridging the Gap Between POS, Purchasing, & Self-Billing

Most POS system software used in retail shops only handles sales transactions. However, full compliance with LHDN’s e-invoicing framework requires integrating purchasing (raw materials, rent, utilities) and self-billing (staff claims, overtime, medical reimbursements).

JomeInvoice solves this by acting as the central bridge between your POS system, accounting software, payroll systems, and more, ensuring all components of your business operations are tracked, synced, and submitted in a unified e-invoice log.

🧩 POS System Compatibility? Not a Problem with JomeInvoice

Still using legacy or offline POS systems from the early 2000s? Locked into a branded ecosystem like H&M or Padini, where updates require corporate approval?

JomeInvoice allows you to stay compliant without overhauling your tech stack. It can:

-

- Translate spreadsheets or data exports into LHDN-compliant formats

-

- Automatically sync purchasing and expense data alongside sales

-

- Seamlessly connect with accounting tools like SQL, QuickBooks, and AutoCount—even if they aren’t natively integrated with your POS

💰 Reduce Integration Costs & Boost ROI with Middleware

Custom development to build POS-to-eInvoice links can be costly and time-consuming. JomeInvoice lowers these barriers by offering:

-

- Pre-built integrations for popular accounting and POS systems

-

- Scalable architecture that grows with your retail business

-

- Shared infrastructure and expert support—cutting both upfront and maintenance costs

You get faster invoice validation, reduced human error, and complete LHDN compliance—all with minimal disruption.

☁️ Cloud-Ready for Modern Retail Environments

Already running a cloud-based POS system for retail shop operations? JomeInvoice enhances your compliance capabilities even further:

-

- Real-time data syncing from POS to accounting to LHDN

-

- One dashboard for Sales, Purchasing, and Self-Billing activities

-

- Compatibility with HR, ERP, WMS, and payroll systems

For international brands operating in Malaysia, JomeInvoice makes local compliance as easy as connecting to a secure middleware gateway.

✅ Get Future-Ready with JomeInvoice

With JomeInvoice, Malaysia’s retail businesses now have a turnkey e-invoicing solution that connects the dots between your POS system, finance, HR, and compliance workflows—without replacing everything you already use.

Whether you’re a single-store operator or a nationwide brand, JomeInvoice makes it simple, affordable, and seamless to stay compliant with Malaysia’s 2025 e-invoicing mandate.

👉 Explore the full solution at jomeinvoice.my and get your business ready for the future of digital compliance.

Contact JomeInvoice Sdn Bhd:

-

- Address:

Level 38, MYEG Tower, Empire City Damansara, Jalan PJU 8, Damansara Perdana, 47820 Petaling Jaya, Selangor

D-04-07, Plaza Bukit Jalil (Aurora Place), No. 1, Persiaran Jalil 1, Bandar Bukit Jalil, 57000 Kuala Lumpur

- Address:

-

- Phone: +6016-732 0163

Don’t wait—schedule a free e-invoice service consultation today and see why JomeInvoice is the top choice for businesses nationwide!