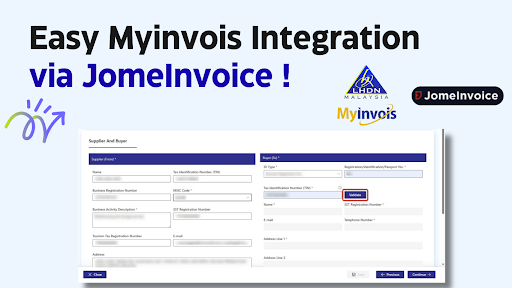

A practical guide for businesses ready to integrate with MyInvois Portal — and how JomeInvoice removes the technical hassle by handling API integration, compliance logic, and invoice submission on your behalf. JomeInvoice provides a ready-built integration that handles API connectivity, LHDN compliance, invoice submission, and post-issuance workflows such as refunds and self-billing.

Malaysia’s e-Invoice mandate has made MyInvois integration a real operational requirement — not just a compliance checkbox.

For many businesses, the first question isn’t whether to comply, but:

“Do we really need to build a custom integration just to connect to MyInvois?”

The short answer: No.

In this guide, we’ll walk you through:

- What MyInvois Portal integration actually means

- Why building your own e-Invoice integration is costly and risky

- How businesses can integrate existing systems without internal development

- A practical, compliant alternative using JomeInvoice

What Does It Mean to Integrate with the MyInvois Portal?

Integrating with the MyInvois portal means your business system can:

- Automatically submit e-Invoices to LHDN

- Receive validation results (approved / rejected)

- Generate compliant documents (Invoice, Credit Note, Debit Note, Refund Note, Self-Billing)

- Store and track e-Invoice status for audit purposes

In practice, this usually involves:

- API connections to MyInvois

- Mapping your internal data to LHDN-required fields

- Handling errors, rejections, and spec updates

This is where complexity — and cost — starts to grow.

Why Many Businesses Avoid Building Their Own MyInvois Integration

On paper, building a direct MyInvois integration sounds straightforward. In reality, it comes with several hidden challenges.

1. High Development & Maintenance Cost

A custom e-Invoice integration requires:

- Backend developers

- API maintenance

- Continuous updates when LHDN changes formats or rules

For most SMEs, this becomes a long-term cost, not a one-off project.

2. Frequent LHDN Specification Updates

MyInvois technical specifications evolve.

Every update means:

- Code changes

- Retesting

- Risk of non-compliance if updates are missed

Businesses without a dedicated tech team often struggle to keep up.

3. Data Validation & Rejection Risks

Even small issues can cause invoice rejection:

- Incorrect tax codes

- Invalid TINs

- Incomplete mandatory fields

Handling these errors manually increases operational friction and delays invoicing.

4. Compliance Risk Is Still on You

When you build it yourself:

- Compliance responsibility stays internal

- Any mistake may result in penalties or audit exposure

For many businesses, this risk outweighs the perceived control of a custom build.

The Smarter Myinvois Integration Alternative: Use a Certified e-Invoicing Middleware

Instead of building from scratch, many Malaysian businesses are adopting an e-invoicing middleware approach.

An e-invoicing middleware platform:

- Connects your existing system to MyInvois

- Handles API complexity and updates

- Ensures ongoing LHDN compliance

This allows businesses to focus on operations — not technical maintenance.

How JomeInvoice Enables MyInvois Integration Without Development for Malaysia Businesses

JomeInvoice is designed as an e-invoice middleware, not an accounting system.

That means you don’t need to change how your business already works.

1. Works with Your Existing Systems

JomeInvoice integrates with:

- POS systems

- ERP systems

- eCommerce platforms (e.g. WooCommerce, Shopify)

- Custom internal systems via structured data input

You continue issuing invoices as usual — JomeInvoice handles MyInvois submission.

2. No API Building Required

With JomeInvoice:

- No need to develop or maintain MyInvois APIs

- No need to monitor spec changes

- No technical onboarding required

All MyInvois logic is handled within the platform.

3. Built-In LHDN Compliance e-Invoicing Logic

JomeInvoice automatically manages:

- Required invoice fields

- Tax Identification Number (TIN)

- Credit Note, Debit Note, Refund Note workflows

- Self-Billing scenarios

This significantly reduces rejection rates and manual correction work.

4. Real-Time Validation & Status Tracking

Businesses can:

- Submit e-Invoices in one click

- Track approval or rejection status

- Store validated invoices for audit readiness

No more switching between systems or portals.

Who Is This Approach Best For?

Using an e-invoicing middleware like JomeInvoice is ideal if your business:

- Uses POS, ERP, or eCommerce systems

- Does not want to invest in in-house development

- Needs fast, compliant MyInvois onboarding

- Wants to reduce accounting and technical dependency

This applies to Malaysia retailers, service providers, eCommerce sellers, agencies, and multi-branch operations.

Common Question: Is This Still Compliant with LHDN e-Invoice?

Yes.

JomeInvoice submits invoices directly to MyInvois Portal and follows LHDN technical and regulatory requirements.

Businesses remain compliant without handling the technical layer themselves.

Final Thoughts: Compliance Without Complexity

Integrating with the MyInvois portal doesn’t have to mean:

- Hiring developers

- Rebuilding systems

- Managing APIs and spec changes

With the right approach, businesses can:

- Stay compliant

- Reduce operational burden

- Continue using their existing systems

You don’t need to build the integration yourself — you just need the right e-Invoice layer.

Next Step

If your business is exploring MyInvois integration and wants a simpler path to compliance, JomeInvoice provides a practical, system-friendly solution.

Learn how JomeInvoice – the best e-invoice software Malaysia that fits into your existing workflow — without accounting systems, without development, and without unnecessary complexity, while remaining fully MyInvois-compliant.

Why Businesses Use JomeInvoice for MyInvois Integration

For businesses that want to integrate with the MyInvois portal without building and maintaining their own solution, JomeInvoice offers a practical and proven approach as a reliable e-invoice sofware for SMEs and large enterprises.

JomeInvoice is designed specifically to handle e-Invois submission and compliance, rather than replacing existing accounting, ERP, or POS systems. This allows businesses to meet LHDN e-invoicing requirements while continuing to operate with the systems and workflows they already use.

Key reasons businesses choose JomeInvoice include:

- Ready-built MyInvois integration

JomeInvoice manages API connectivity, data formatting, and submission logic, eliminating the need for internal development or ongoing technical maintenance. - LHDN-compliant by design

The platform incorporates required invoice fields, tax identification number (TIN) verification and support for credit notes, debit notes, refunds, and self-billing scenarios. - System-agnostic integration

JomeInvoice works alongside e-Invoice POS systems, ERP platforms, eCommerce e-Invoicing solutions, and internal business systems, making it suitable for both SMEs and larger organisations. - Operational simplicity

A central dashboard allows businesses to submit, track, and store validated e-Invoices without switching between multiple systems or portals. - Ongoing compliance support

As MyInvois specifications evolve, updates are managed within the platform, reducing compliance risk for businesses over time.

By acting as an e-invoicing middleware between business systems and the MyInvois portal, JomeInvoice enables businesses to comply efficiently — without adding accounting complexity or technical burden.