10 Example Scenarios Required Self-Billed e-invoice in Malaysia [2025 Guide]

Learn when self-billed e-invoice are required in Malaysia, including 10 example scenarios like e-commerce, profit distribution, and cross-border transaction.

Learn when self-billed e-invoice are required in Malaysia, including 10 example scenarios like e-commerce, profit distribution, and cross-border transaction.

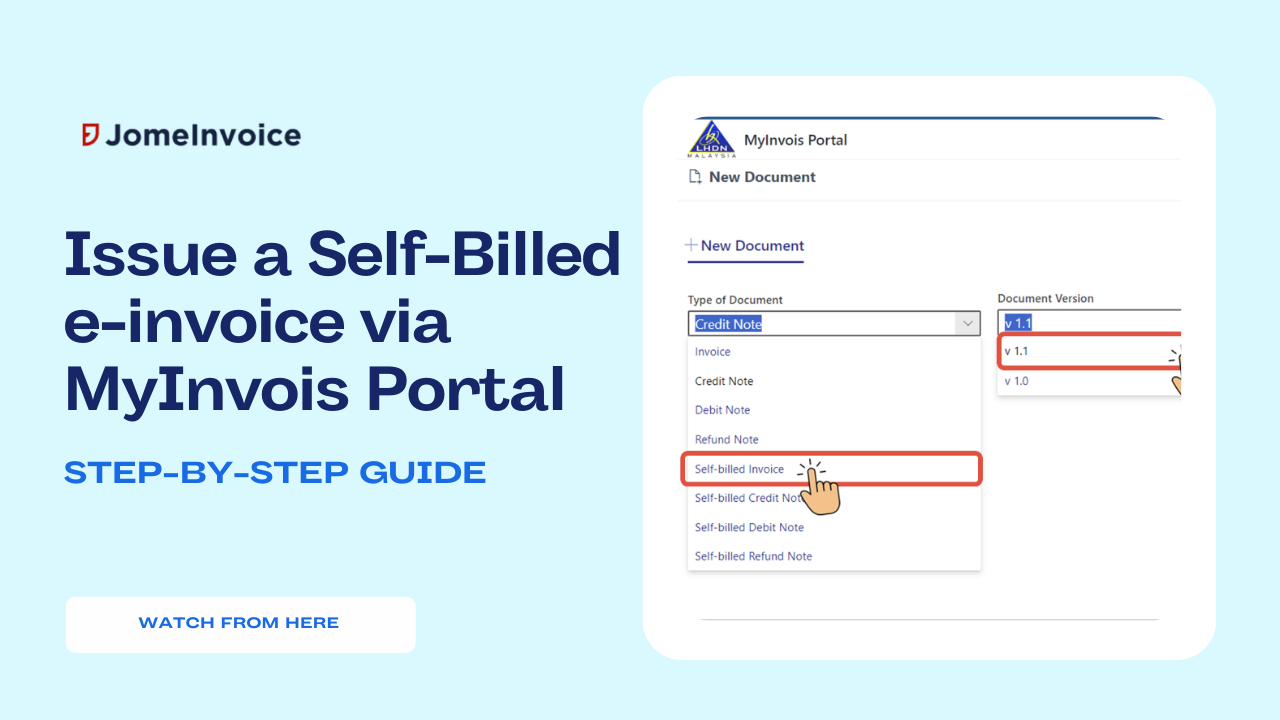

Learn the step-by-step process to issue a self-billed e-invoice Malaysia using MyInvois Portal. Follow our guide for a smooth and efficient e-invoicing experience.

Explore latest LHDN update for Malaysia e-Invoicing FAQs, covering implementation, formats, MSME compliance, API usage, and common errors. Learn everything about MyInvois Portal and the

Discover the best e-invoicing software Malaysia for SMEs, full compliant with LHDN e-invoice 2024/2025 guidelines. Learn key factors like integration, scalability, and data security.

Discover the pros, cons, and cost of MyInvois Portal, API integration, and e-invoicing middleware to find the best e-invoicing model for your business in 2024/2025.

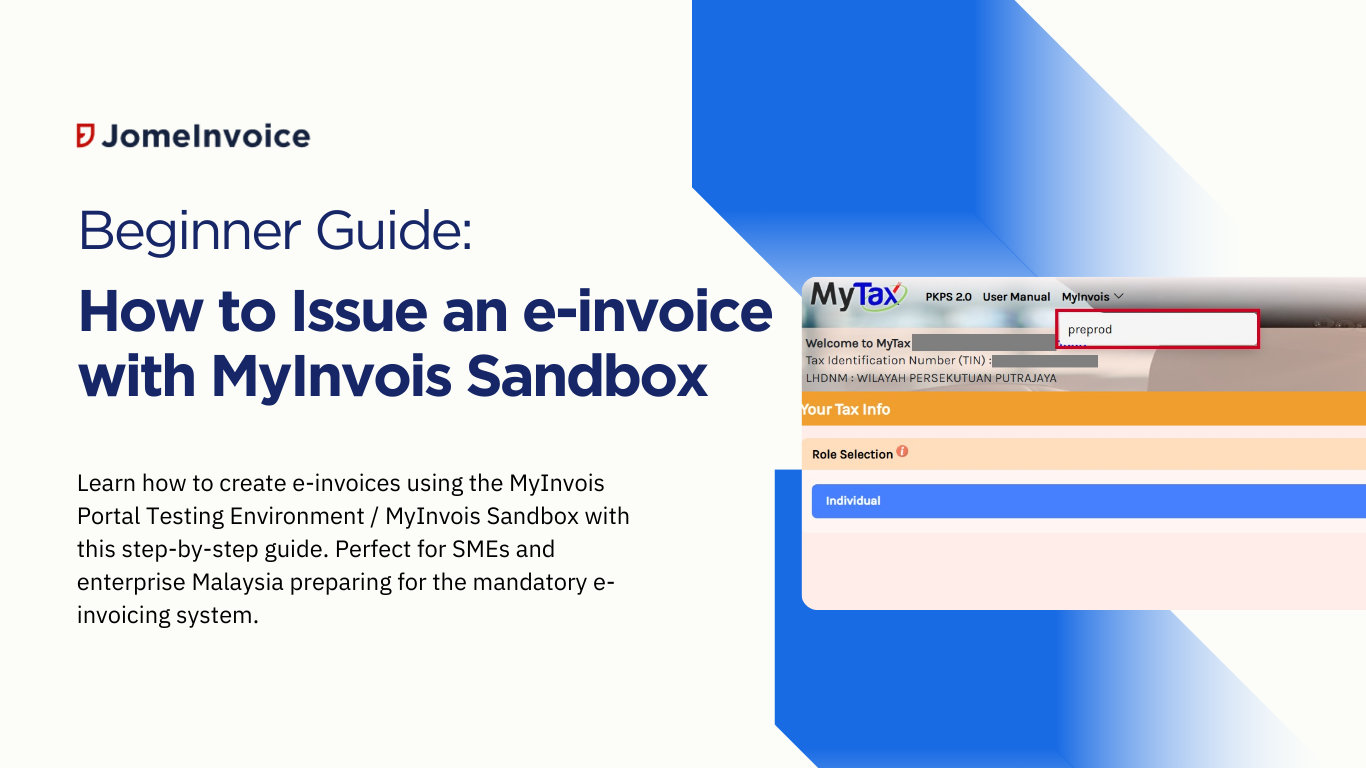

Learn how to create e-invoices using the MyInvois Portal Testing Environment / MyInvois Sandbox with this step-by-step guide. Perfect for SMEs and enterprise Malaysia preparing