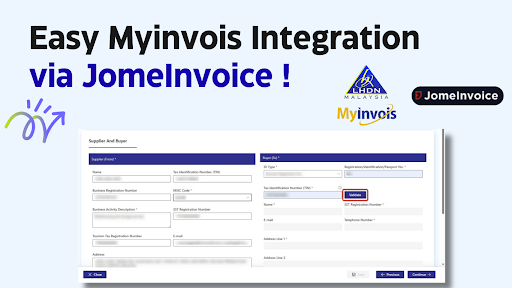

Read Malaysia e-Invoice Compliance Update & e-Invoicing Integration Knowledge Hub

Stay updated with insights on e-invoicing in Malaysia. Learn how JomeInvoice supports secure and automated billing for SMEs, retailers, eCommerce sellers, and large enterprises. Explore practical guides on LHDN e-invoice rules, e-invoice integration, and e-invoicing solutions.