The Malaysian government has rolled out the e-Invoice Malaysia system, which has become a powerful tool for the Inland Revenue Board of Malaysia (LHDN) to uncover tax avoidance and fraud. This system, integrated with customs and tax data, helps track suspicious activities and ensures compliance with tax regulations.

In this article, we will explore how e-Invoicing is playing a critical role in tackling tax avoidance and how Malaysian businesses can avoid falling into common traps.

1. The Power of e-Invoicing in Uncovering Tax Avoidance

Since the introduction of e-Invoicing Malaysia, the government has made significant strides in catching tax evasion. According to reports, LHDN has discovered RM58 million in tax avoidance by businesses. Thanks to the e-Invoice system, they have already recovered RM82 million in taxes. This is just the beginning, with plans to expand this system further across the country.

The e-Invoicing system works by electronically recording all transactions, making it easier for authorities to identify discrepancies between reported income and actual sales. As of July 2025, 87,573 companies have adopted the system, with significant participation across the four stages of implementation. (enanyang, 2025)

2. How e-Invoicing Malaysia Tracks Tax Avoidance

The e-Invoicing Malaysia system doesn’t just track sales tax and service tax. It also plays a vital role in preventing tax avoidance on imported goods and services. Here’s how LHDN uses e-Invoices to monitor tax compliance:

i) Cross-checking with Customs Data

One of the major advantages of e-Invoicing is its integration with customs data. The Inland Revenue Board shares the data from e-Invoices with the Customs Department. This collaboration allows the government to:

- Check for Service Tax: The system can cross-reference the MSIC Code and Classification Code to determine whether service tax should have been applied. If it’s missing, the LHDN and Customs Department immediately know.

- Monitor Imported Goods: When goods are imported, the e-Invoice automatically references the K1 import declaration number. If the goods are subject to sales or import tax, the system flags discrepancies.

ii) Tax Avoidance in Importing Goods and Services

For businesses importing goods or services, tax avoidance is often hidden in underreported values or incorrect customs declarations. Let’s break this down:

- Example of Importing Goods: A business imports goods worth RM100,000 but pays the supplier RM500,000. This discrepancy would go unnoticed without e-Invoicing. The Customs Department will flag this as an attempt to evade import duties and sales tax. The government can then assess taxes and issue penalties accordingly.

- Example of Importing Services: Services imported into Malaysia are subject to 8% Import Service Tax. Even if the business doesn’t collect service tax from the client, LHDN and the Customs Department can spot this discrepancy through the e-Invoice system.

3. The Role of K1 Form in Tax Avoidance Detection

The K1 form is essential for businesses importing goods and services. It provides the necessary declaration for customs clearance and links the goods or services to the corresponding tax obligations. Here’s how the K1 form helps detect tax avoidance:

- If businesses fail to report the K1 number or declare an incorrect value for their imports, the e-Invoice system flags these discrepancies.

- Import Service Tax: As mentioned earlier, imported services are subject to an additional 8% service tax. Many businesses mistakenly think they can avoid this tax by using Classification Code 035, but the LHDN and Customs Department can easily detect the tax gap through the e-Invoicing system.

4. Penalties for Tax Avoidance

If businesses fail to declare their taxes correctly, they face significant consequences:

- Underreported Duties: If a business underreports the value of imported goods, they may face backdated tax assessments, with penalties for the difference in duty paid.

- Fines for Non-compliance: The LHDN can impose fines for failing to pay taxes correctly, especially for sales tax or import service tax. These fines can be substantial, and in some cases, businesses may also lose the ability to claim tax deductions.

5. How to Avoid Tax Avoidance and Ensure Compliance

With the e-Invoicing Malaysia system becoming more robust, businesses need to adapt quickly to avoid penalties for tax avoidance. Here’s what you can do:

- Ensure Accurate Reporting: Always report your imports accurately, including all relevant taxes like sales tax and import service tax.

- Understand the MSIC and Classification Codes: Incorrectly applying the MSIC Code or Classification Code for products or services can lead to compliance issues. Make sure your codes match the type of goods or services you are dealing with.

- Use the Correct K1 Form: If you’re importing goods or services, ensure the K1 form is completed correctly. Failing to do so will flag your transactions for audit.

- Regularly Update Your Tax Compliance: Stay on top of e-Invoicing and any updates to tax regulations, including the introduction of Import Service Tax or changes to Withholding Tax.

6. Conclusion: How e-Invoicing Malaysia Helps in Tackling Tax Avoidance

The implementation of e-Invoicing Malaysia is a game-changer in the fight against tax avoidance. By integrating data from various departments, including LHDN and the Customs Department, the government can easily track discrepancies and ensure compliance. Businesses need to stay vigilant about correctly issuing e-Invoices, applying the right Classification Codes, and accurately declaring import service taxes to avoid penalties.

As Malaysia continues to expand the e-Invoicing system, it’s crucial for businesses to understand the implications of tax avoidance and ensure full compliance with tax regulations.

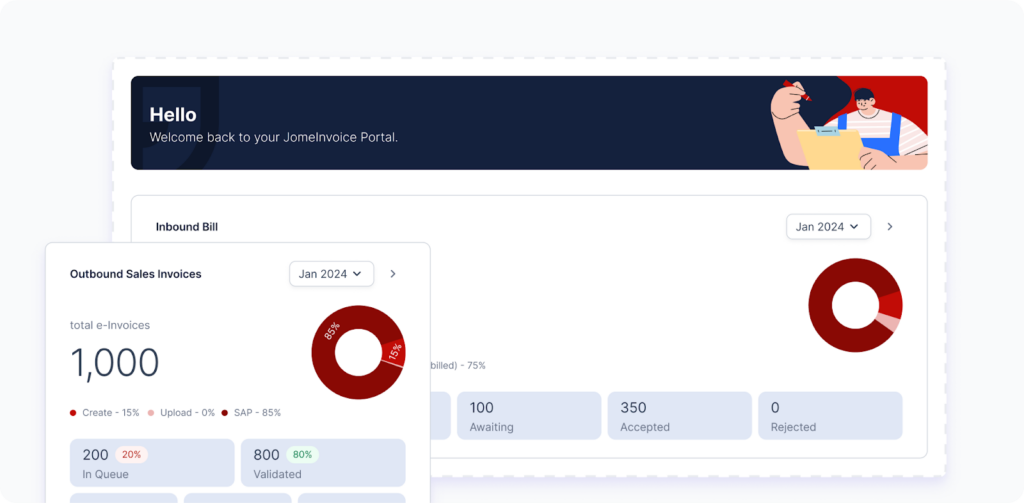

Need Help to Implement e-Invoice Seamlessly? Explore the Best e-Invoicing Software Malaysia – JomeInvoice

JomeInvoice: Best e-Invoicing Software Malaysia

When it comes to integrating best e-Invoicing software solutions for both small and large enterprise Malaysia, JomeInvoice has quickly become a standout choice, positioning itself among the top middleware as e-Invoicing platforms in the country. With its user-friendly features and robust e-Invoice system compatibility, it’s no surprise why many businesses are turning to JomeInvoice for a seamless transition to the LHDN e-Invoice compliance.

Why JomeInvoice is the Best e-Invoicing Software Provider for SMEs and Large Enterprise Malaysia:

JomeInvoice stands out as the most user-friendly and comprehensive e-Invoicing software solution, offering the perfect balance of flexibility, compliance, and support for both SMEs and large enterprise Malaysia. Whether you are transitioning into the LHDN e-Invoicing mandate or looking to streamline your current invoicing process, JomeInvoice provides everything you need—from free trials to ongoing updates and local support.

- Flexible System Compatibility

JomeInvoice offers seamless integration with popular systems such as SAP ECC6, S4 Hana, Sage300, MS365, Netsuite, Odoo, Xero & etc. This flexibility makes it ideal for businesses of all sizes—whether you’re an SME or a large enterprise Malaysia, JomeInvoice adapts to your current operations without a hitch. - Full Compliance with LHDN e-Invoicing Regulations

Compliance is key, and JomeInvoice ensures that your business meets all LHDN e-Invoicing guidelines. ISO-certified and fully PDPA-compliant, JomeInvoice offers a secure, worry-free invoicing process that keeps you aligned with Malaysia’s regulatory standards. - Trusted by Leading Businesses

Over 60+ major companies, including those in Phase 1 of Malaysia e-Invoicing compliance, rely on JomeInvoice for their invoicing needs. The platform is proven to handle large-scale, complex transactions seamlessly, making it a trusted choice across industries. - Free Upgrades, Training, and Dedicated Support

JomeInvoice keeps your business up to date with automatic upgrades that maintain LHDN compliance. Plus, free training and access to a dedicated Malaysian support team ensure your staff can easily adapt to the platform. With cloud server capabilities, you’ll also benefit from secure, flexible invoicing solutions. - Backed by a Listed Company

JomeInvoice is not just reliable but also backed by a publicly listed company on Bursa Malaysia. This adds an extra layer of trust and assurance for businesses looking to invest in long-term solutions.

Ready to streamline your e-Invoicing processes?

Contact JomeInvoice today and take advantage of the comprehensive e-Invoicing software features! Our dedicated team is ready to help your business stay ahead with compliance and efficiency.

Contact JomeInvoice Sdn Bhd:

- Address:

Level 38, MYEG Tower, Empire City Damansara, Jalan PJU 8, Damansara Perdana, 47820 Petaling Jaya, Selangor

D-04-07, Plaza Bukit Jalil (Aurora Place), No. 1, Persiaran Jalil 1, Bandar Bukit Jalil, 57000 Kuala Lumpur - Phone: +6016-732 0163

- Social Media:

LinkedIn | Facebook

Don’t wait—schedule a free e-Invoice service consultation today and see why JomeInvoice is the top choice for businesses nationwide!

Read More on e-Invoicing Malaysia Latest Updates

When Must New Businesses Exceeding RM500k in Revenue in 2023–2025 Start e-Invoicing in Malaysia