Malaysia’s e-invoicing implementation is undergoing a major update. Starting January 1, 2026, the list of transactions exempt from consolidated e-invoice has expanded from 7 to 10. This e-invoicing Malaysia update brings changes across several sectors, which will affect how businesses handle their transactions moving forward.

Here’s an in-depth look at the e-invoicing implementation and the key industries affected by these changes.

1. Automotive Trading Exempt from Consolidated e-Invoice

- Transactions excluded: The sale of vehicles like cars, trucks, motorcycles, and other road vehicles will not require consolidated e-invoices.

Example:

- Car dealerships and automotive businesses will need to follow traditional invoicing methods for vehicle transactions.

2. Aviation Sector Exempt from e-Invoice Consolidation

- Transactions excluded: Airline ticket sales and related aviation services will be exempt from the consolidated e-invoice implementation.

Example:

- Airlines like AirAsia and Malaysia Airlines will continue using traditional invoicing for ticket sales and services.

3. Luxury Goods & Jewellery Transactions Not Covered by Consolidated e-Invoice

- Transactions excluded: The sale of high-value luxury items such as jewelry, watches, and designer goods will remain outside of the consolidated e-invoicing system.

Example:

- Retailers selling luxury handbags, watches, and diamonds are not required to issue consolidated e-invoices.

4. Construction Contracts Require Transaction-Level e-Invoices, No Consolidation Allowed

- Transactions covered: Under the IRBM e-Invoice Guideline v4.4, construction contracts require transaction-level e-invoices. Consolidated e-invoices are not allowed for construction contracts, regardless of project size or whether the work is done by a main contractor or a subcontractor.

Example:

- A contractor issuing an invoice for a small renovation job, or a subcontractor billing for part of a project, must issue an individual e-invoice for each transaction. They cannot combine multiple construction transactions into one consolidated e-invoice.

5. Wholesale & Retail of Construction Materials Exempt from e-Invoice Consolidation

- Transactions covered:

Businesses involved in the wholesale or retail supply of construction materials must issue transaction-level e-invoices for every sale. Consolidated e-invoices are not permitted under IRBM E-Invoice Specific Guideline v4.4.

Example:

- A supplier selling cement, steel, or construction materials must issue an individual e-invoice for each sale. Multiple sales cannot be combined into a single consolidated e-invoice, even for low-value or cash transactions.

6. Licensed Betting & Gaming Transactions Exempt from Consolidated e-Invoicing

- Transactions excluded: Payments made to winners of licensed betting and gaming activities, such as those from TOTO, Magnum, and Da Ma Cai, will not require consolidated e-invoices.

Example:

- Gaming businesses will not need to use e-invoices when processing payouts for lottery winners.

7. Payments to Agents, Dealers, and Distributors Not Included in Consolidated e-Invoicing

- Transactions excluded: Commission payments made to agents, dealers, or distributors will be exempt from consolidated e-invoicing.

Example:

- Commissions and incentives paid to agents or distributors for products or services will not require e-invoices.

New Additions to the List: 8-10 Transactions Exempt from Consolidated e-Invoice

8. Transactions Over RM10K Exempt from Consolidated e-Invoice

- Transactions excluded: Any single transaction exceeding RM10,000 will not be covered by the consolidated e-invoice system, effective from January 1, 2026.

Example:

- A customer purchasing a sofa for RM9,999 and a pillow for RM3,999 will be required to issue separate e-invoices as the total exceeds RM10K.

9. Electricity Supply Exempt from Consolidated e-Invoice

- Transactions excluded: The supply of electricity by providers such as Tenaga Nasional will not require consolidated e-invoices.

Example:

- Utility providers will not be required to issue consolidated e-invoices for electricity consumption.

10. Telecommunication, Internet, and Electronics Exempt from Consolidated e-Invoice

- Transactions excluded: Telecommunication services, internet subscriptions, and electronics sales will remain outside the consolidated e-invoicing system.

Example:

- Telecom companies like Digi, Unifi, and U Mobile are exempt from issuing e-invoices for mobile plans or internet subscriptions.

Why the e-Invoicing Malaysia Update Matters

- Improved Compliance and Efficiency: While consolidated e-invoices are mandatory for most industries, businesses in these 10 categories will continue with traditional invoicing methods, ensuring smooth compliance with existing tax regulations.

- Transparency in Business Transactions: The e-invoicing Malaysia update helps improve business transparency and reduces the risk of errors, making it easier for businesses to comply with tax regulations.

Conclusion: e-Invoicing Malaysia Update’s Impact on Businesses

The consolidated e-invoice implementation is a key update for businesses in Malaysia. Starting on January 1, 2026, these 10 types of transactions will be excluded from the e-invoicing system, which may affect industries like automotive trading, aviation, construction, and more. Companies in these sectors must adjust their invoicing systems to ensure they remain compliant with the new regulations.

This e-invoicing Malaysia update signifies a shift towards greater digital transparency and operational efficiency across various sectors. Be sure to prepare for these changes well ahead of the January 2026 deadline.

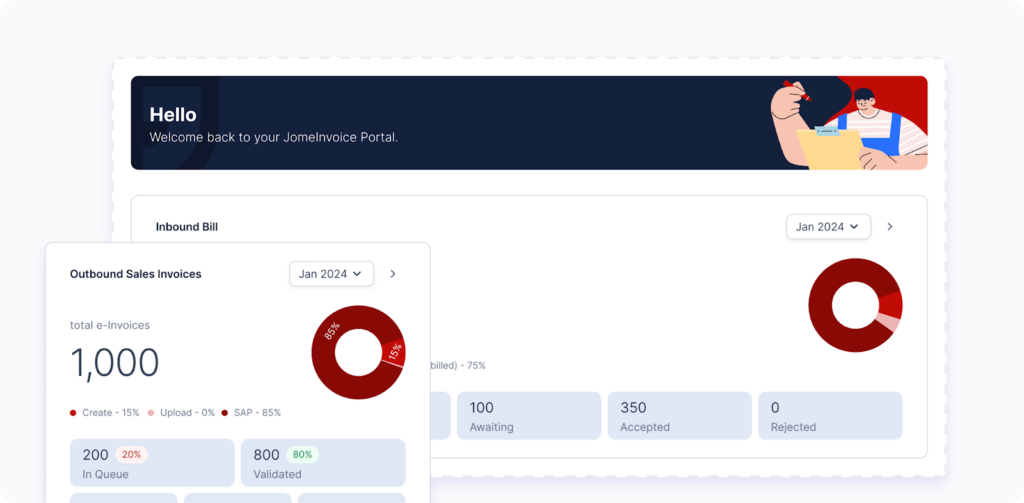

Need Help to Implement e-invoice Seamlessly? Explore the Best e-invoicing Software Malaysia – JomeInvoice

JomeInvoice: Best e-invoicing Software Malaysia

When it comes to integrating best e-invoicing software solutions for both small and large enterprise Malaysia, JomeInvoice has quickly become a standout choice, positioning itself among the top middleware as e-invoicing platforms in the country. With its user-friendly features and robust e-invoice system compatibility, it’s no surprise why many businesses are turning to JomeInvoice for a seamless transition to the LHDN e-invoice compliance.

Why JomeInvoice is the Best e-invoicing Software Provider for SMEs and Large Enterprise Malaysia:

JomeInvoice stands out as the most user-friendly and comprehensive e-invoicing software solution, offering the perfect balance of flexibility, compliance, and support for both SMEs and large enterprise Malaysia. Whether you are transitioning into the LHDN e-invoicing mandate or looking to streamline your current invoicing process, JomeInvoice provides everything you need—from free trials to ongoing updates and local support.

- Flexible System Compatibility

JomeInvoice offers seamless integration with popular systems such as SAP ECC6, S4 Hana, Sage300, MS365, Netsuite, Odoo, Xero & etc. This flexibility makes it ideal for businesses of all sizes—whether you’re an SME or a large enterprise Malaysia, JomeInvoice adapts to your current operations without a hitch. - Full Compliance with LHDN e-invoicing Regulations

Compliance is key, and JomeInvoice ensures that your business meets all LHDN e-invoicing guidelines. ISO-certified and fully PDPA-compliant, JomeInvoice offers a secure, worry-free invoicing process that keeps you aligned with Malaysia’s regulatory standards. - Trusted by Leading Businesses

Over 60+ major companies, including those in Phase 1 of Malaysia e-invoicing compliance, rely on JomeInvoice for their invoicing needs. The platform is proven to handle large-scale, complex transactions seamlessly, making it a trusted choice across industries. - Free Upgrades, Training, and Dedicated Support

JomeInvoice keeps your business up to date with automatic upgrades that maintain LHDN compliance. Plus, free training and access to a dedicated Malaysian support team ensure your staff can easily adapt to the platform. With cloud server capabilities, you’ll also benefit from secure, flexible invoicing solutions. - Backed by a Listed Company

JomeInvoice is not just reliable but also backed by a publicly listed company on Bursa Malaysia. This adds an extra layer of trust and assurance for businesses looking to invest in long-term solutions.

Ready to streamline your e-invoicing processes?

Contact JomeInvoice today and take advantage of the comprehensive e-invoicing software features! Our dedicated team is ready to help your business stay ahead with compliance and efficiency.

Contact JomeInvoice Sdn Bhd:

- Address:

Level 38, MYEG Tower, Empire City Damansara, Jalan PJU 8, Damansara Perdana, 47820 Petaling Jaya, Selangor

D-04-07, Plaza Bukit Jalil (Aurora Place), No. 1, Persiaran Jalil 1, Bandar Bukit Jalil, 57000 Kuala Lumpur - Phone: +6016-732 0163

- Social Media:

LinkedIn | Facebook

Don’t wait—schedule a free e-invoice service consultation today and see why JomeInvoice is the top choice for businesses nationwide!

Read More on e-invoicing Malaysia Latest Updates

When Must New Businesses Exceeding RM500k in Revenue in 2023–2025 Start E-invoicing in Malaysia