Upgrade your POS for e-invoicing in Malaysia: A cost-benefit analysis

Upgrading your POS system for e-invoicing in Malaysia is a crucial decision for businesses aiming to stay compliant with the nation’s e-invoicing regulations. As e-invoicing Malaysia becomes mandatory, especially for businesses with an annual turnover exceeding RM5 million, the transition to a POS system for small retail business or larger retail operations is no longer optional.

Key Benefits of Upgrading Your POS System for e-invoicing Malaysia

1. Compliance with Malaysian Tax Regulations

E-invoicing is now mandatory for all businesses in Malaysia by July 1, 2026. However, businesses with annual revenue exceeding RM5 million were required to comply starting July 1, 2025. Upgrading your retail POS system ensures that your business stays compliant with e-invoice software requirements set by the Inland Revenue Board of Malaysia (LHDN).

Note: e-Invoice regulations may change. This article reflects information available at the time of publication. For the latest updates and timelines, refer to our Latest e-Invoice Updates page.

2. Operational Efficiency

Automating the invoicing process through an e-invoice platform drastically reduces manual effort and errors. This leads to smoother bookkeeping and faster invoice processing—benefits that can enhance operational efficiency, particularly for businesses using multiple POS systems for retail stores.

3. Cost Savings

With e-invoicing for retail Malaysia, you can eliminate costs associated with paper invoices, such as printing, postage, and storage. These savings can be significant, especially for businesses that process a large number of invoices each month.

4. Improved Accuracy

E-invoicing systems use standardized formats and automated data validation, reducing the risk of errors and disputes. By upgrading your POS system for e-invoicing, you ensure accurate and reliable invoicing for your small retail business, improving accuracy in both sales and purchasing data.

5. Faster Payments

Upgrading to e-invoicing can accelerate invoice approval and payment cycles, leading to better cash flow management. Real-time data processing ensures that your business receives payments faster, which is vital for maintaining liquidity.

6. Enhanced Tax Compliance

Real-time reporting enhances tax compliance and auditability, aligning your business with LHDN standards. The seamless integration of e-invoicing software into your POS systems for retail store ensures accurate financial reporting, reducing the chances of penalties or audits.

7. Data Security

E-invoicing for small retail businesses ensures that sensitive financial data is transmitted and stored securely. This protects against fraud and data breaches, providing peace of mind for business owners.

8. Sustainability

By transitioning to e-invoicing Malaysia, you contribute to sustainability goals by reducing paper waste, aligning your business with eco-friendly practices.

Potential Costs and Challenges of Upgrading Your POS System for E-Invoicing

1. Software Upgrades and Integration

The primary challenge involves ensuring that your POS system for e-invoicing integrates smoothly with your ERP systems. This is especially complex for businesses using outdated or legacy systems. However, middleware solutions can bridge the gap, allowing you to sync POS systems for retail store data with e-invoice platforms without requiring a full system replacement.

2. Upfront Investment

Upgrading your POS system for small retail business to one that supports e-invoice software comes with an upfront cost. This may involve purchasing new hardware, software, or opting for API integrations. While these costs can be significant, they are outweighed by the long-term benefits.

3. Training

Employees will need training to adapt to the new workflows and systems, particularly in using e-invoice platforms for invoicing and reporting. Ensuring that your staff is well-prepared can prevent errors and ensure smooth operation.

4. Ongoing Fees

Many e-invoice service providers charge monthly or annual fees. This is an ongoing cost to consider when budgeting for a POS system for e-invoicing.

5. Data Accuracy and Integration

Ensuring accurate data transfer and synchronization between your POS systems for retail store and e-invoice platforms is vital for compliance. Businesses with multiple POS systems for retail store will need to ensure consistency in reporting across all outlets.

Malaysia Government Support for E-Invoicing Adoption

The Malaysian government is offering support to ease the transition to e-invoicing Malaysia:

1. MyInvois Portal

The MyInvois Portal is available for businesses to submit their e-invoices. It is free for use and a great option for micro, small, and medium-sized enterprises (MSMEs) that may not need a full-fledged e-invoice platform.

2. Incentives and Grants

- Tax deductions for consultation fees related to implementation (up to RM50,000 annually from 2024 to 2027).

- Capital allowance claims for ICT equipment and software ( accelerated claim period for YA 2024 and YA 2025).

- Digitalisation grants (up to RM5,000) for upgrading POS systems or other digital tools, which can help support e-Invoicing adoption.

Our Recommendation: Upgrade Your POS System for E-Invoicing with JomeInvoice [Both SME & Large Enterprises Friendly]

E-invoicing is mandatory for all businesses in Malaysia, and upgrading your POS system for e-invoicing is a crucial step to remain compliant with regulations. The benefits of e-invoicing for retail Malaysia are clear—enhanced operational efficiency, cost savings, and improved tax compliance. As businesses prepare for the July 1, 2026 deadline, it’s important to assess your current systems and consider integration options, such as middleware solutions, to ensure a smooth transition.

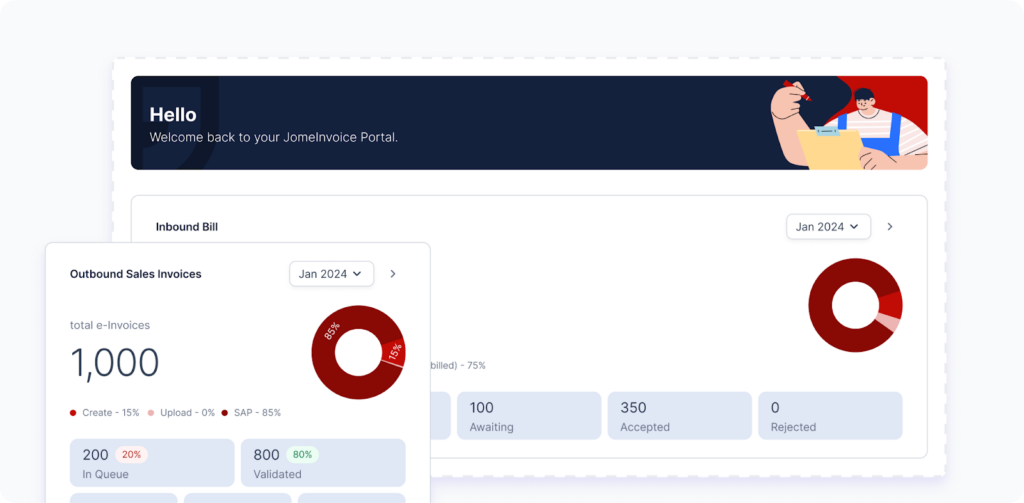

For a seamless POS system upgrade, JomeInvoice provides a reliable e-invoice platform that connects your retail POS system with the necessary e-invoicing features. With JomeInvoice, businesses can streamline their invoicing processes, enhanced operational efficiency, cost savings, and improve tax compliance.

Utilize government grants and incentives to make this transition more affordable, and choose a solution that best aligns with your business’s size, needs, and budget.

Start Preparing Today: E-Invoicing Implementation Timeline

The phased implementation of e-invoicing Malaysia is based on the annual turnover or revenue of taxpayers. The earlier you upgrade your POS system for e-invoicing, the better prepared your business will be for these regulatory changes.

Need Help to Implement e-invoice Seamlessly? Explore the Best e-invoicing Software Malaysia – JomeInvoice

JomeInvoice: Best e-invoicing Software Malaysia

When it comes to integrating best e-invoicing software solutions for both small and large enterprise Malaysia, JomeInvoice has quickly become a standout choice, positioning itself among the top middleware as e-invoicing platforms in the country. With its user-friendly features and robust e-invoice system compatibility, it’s no surprise why many businesses are turning to JomeInvoice for a seamless transition to the LHDN e-invoice compliance.

Why JomeInvoice is the Best e-invoicing Software Provider for SMEs and Large Enterprise Malaysia:

JomeInvoice stands out as the most user-friendly and comprehensive e-invoicing software solution, offering the perfect balance of flexibility, compliance, and support for both SMEs and large enterprise Malaysia. Whether you are transitioning into the LHDN e-invoicing mandate or looking to streamline your current invoicing process, JomeInvoice provides everything you need—from free trials to ongoing updates and local support.

- Flexible System Compatibility

JomeInvoice offers seamless integration with popular systems such as SAP ECC6, S4 Hana, Sage300, MS365, Netsuite, Odoo, Xero & etc. This flexibility makes it ideal for businesses of all sizes—whether you’re an SME or a large enterprise Malaysia, JomeInvoice adapts to your current operations without a hitch. - Full Compliance with LHDN e-invoicing Regulations

Compliance is key, and JomeInvoice ensures that your business meets all LHDN e-invoicing guidelines. ISO-certified and fully PDPA-compliant, JomeInvoice offers a secure, worry-free invoicing process that keeps you aligned with Malaysia’s regulatory standards. - Trusted by Leading Businesses

Over 60+ major companies, including those in Phase 1 of Malaysia e-invoicing compliance, rely on JomeInvoice for their invoicing needs. The platform is proven to handle large-scale, complex transactions seamlessly, making it a trusted choice across industries. - Free Upgrades, Training, and Dedicated Support

JomeInvoice keeps your business up to date with automatic upgrades that maintain LHDN compliance. Plus, free training and access to a dedicated Malaysian support team ensure your staff can easily adapt to the platform. With cloud server capabilities, you’ll also benefit from secure, flexible invoicing solutions. - Backed by a Listed Company

JomeInvoice is not just reliable but also backed by a publicly listed company on Bursa Malaysia. This adds an extra layer of trust and assurance for businesses looking to invest in long-term solutions.

Ready to streamline your e-invoicing processes?

Contact JomeInvoice today and take advantage of the comprehensive e-invoicing software features! Our dedicated team is ready to help your business stay ahead with compliance and efficiency.

Contact JomeInvoice Sdn Bhd:

- Address:

Level 38, MYEG Tower, Empire City Damansara, Jalan PJU 8, Damansara Perdana, 47820 Petaling Jaya, Selangor

D-04-07, Plaza Bukit Jalil (Aurora Place), No. 1, Persiaran Jalil 1, Bandar Bukit Jalil, 57000 Kuala Lumpur - Phone: +6016-732 0163

- Social Media:

LinkedIn | Facebook

Don’t wait—schedule a free e-invoice service consultation today and see why JomeInvoice is the top choice for businesses nationwide!

Read More on e-invoicing Malaysia Latest Updates

e-invoicing guide for Malaysia Small Businesses Under RM150k Revenue