As Malaysia moves toward full adoption of electronic invoicing (e-invoicing) by 2027, businesses are preparing for significant changes in how they handle e-invoicing and tax compliance. The Inland Revenue Board (IRB) of Malaysia is spearheading this initiative as part of a broader digital transformation aimed at improving efficiency, reducing errors, and ensuring tax compliance across all sectors.

If you’re wondering how to integrate e-invoicing into your business, here’s a breakdown of the available e-invoice Malaysia integration models for 2024 and beyond.

1. Direct API Integration

The Direct API Integration model is designed for businesses with established ERP (Enterprise Resource Planning), billing, or accounting systems. It allows for real-time submission of e-invoices to the MyInvois portal, ensuring that invoices are automatically generated, sent, and validated by the IRB without human intervention.

Benefits:

- Real-time Automation: Invoices are submitted automatically from your ERP system to the IRB database, minimizing manual work.

- Instant Processing: e-invoice Malaysia is validated and processed immediately, which can streamline your operations.

Challenges:

- IT Resource-Intensive: Direct API integration can be complex, requiring significant IT support for setup and continuous updates as regulations evolve.

- Cost: The need to update systems frequently to meet compliance standards could lead to increased costs.

2. e-invoicing Middleware Integration (The Fastest Way)

The e-invoicing Middleware Integration model is an intermediary e-invoicing software solution, perfect for businesses that do not want to overhaul their existing ERP or accounting systems. e-invoicing Middleware like JomeInvoice connects your system with the IRB’s MyInvois portal, facilitating the exchange of invoice data without requiring significant internal changes.

Benefits:

- Low Impact on Current Systems: e-invoicing middleware requires fewer adjustments to existing systems, making it a practical solution for businesses that prefer minimal disruption.

- Compliance Maintenance: The e-invoicing software provider regularly updates the system to ensure compliance with evolving e-invoicing standards.

- Flexibility: Some e-invoicing platforms offer additional features such as QR code generation, which is a mandatory requirement for compliance.

Challenges:

- Dependency on Third-Party Providers: Your business relies on the e-invoicing middleware provider to stay up-to-date with regulatory changes..

3. MyInvois Portal (The Budget-Friendly Option)

For small and medium-sized enterprises (SMEs), the MyInvois Portal, provided by the IRB, offers a free and straightforward solution. This platform allows businesses to manually create, submit, and validate e-invoice Malaysia. It’s ideal for companies that do not have the technical infrastructure for API or middleware integration.

Benefits:

- Free and Accessible: The MyInvois portal is free and easy to use, designed specifically for businesses that handle lower volumes of invoices.

- No Technical Setup Required: You can start using the portal without needing an IT team to integrate with your existing systems.

Challenges:

- Manual Processes: This option may not be feasible for businesses with high transaction volumes, as it requires manual input.

- Limited Automation: Unlike API integration or e-invoicing middleware solutions, the MyInvois portal doesn’t automate the invoicing process.

4. PEPPOL (International Integration)

Malaysia is also working towards integrating PEPPOL (Pan-European Public Procurement On-Line), a global e-invoicing network. This model facilitates cross-border transactions, making it an ideal option for businesses involved in international trade. While not yet mandatory, PEPPOL could become a key component in the future of Malaysia’s e-invoicing landscape.

Benefits:

- International Compliance: PEPPOL allows businesses to issue e-invoice Malaysia that meet international standards, facilitating trade with global partners.

- Future-Ready: As Malaysia continues its digital transformation, PEPPOL may become an important option for companies looking to expand internationally.

Which e-invoice Malaysia Integration Model is Right for You?

Choosing the right e-invoice Malaysia integration model depends on your business size, transaction volume, and technical capabilities. Larger businesses with complex invoicing needs may find Direct API Integration to be the best fit, while e-invoicing Middleware offers a more flexible option for those looking for compliance without extensive system overhauls. For SMEs or businesses with limited technical resources, the MyInvois Portal provides a straightforward and cost-effective solution.

No matter which model you choose, the key to a successful e-invoice Malaysia integration is planning ahead. Conduct impact assessments to evaluate your technical, process, and data requirements, ensuring that your business is prepared for a smooth transition to Malaysia’s e-invoicing mandate.

Final Thoughts on e-invoicing Platform Solutions

Malaysia’s e-invoicing initiative represents a significant step toward digitizing the economy and improving tax compliance. With several integration models available—ranging from full automation with API integration to simpler manual solutions via the MyInvois Portal—businesses of all sizes can find a solution that meets their needs. Prepare now to ensure a seamless transition as e-invoicing becomes mandatory across all sectors by 2027.

Explore the Top 3 e-invoicing Middleware Solutions in Malaysia

JomeInvoice Top 3 e-invoicing Software Malaysia

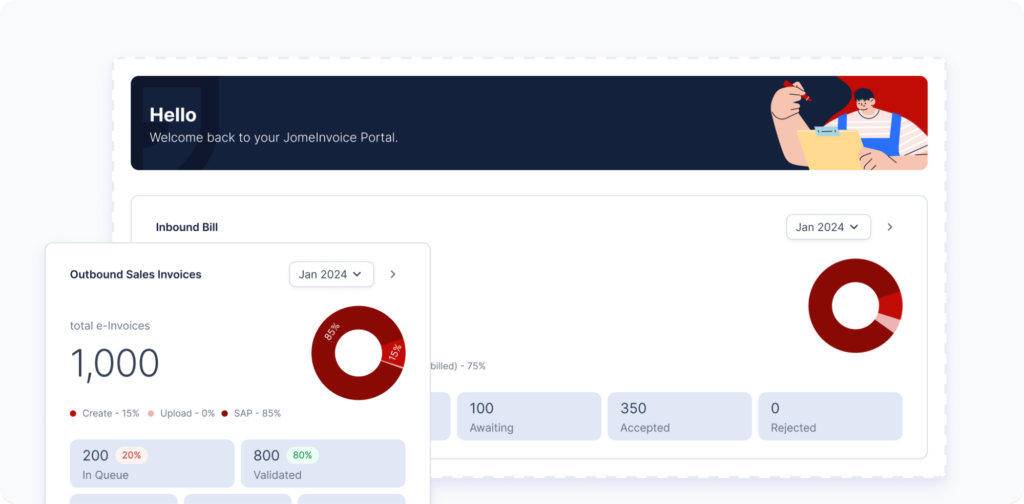

When it comes to integrating e-invoicing software solutions for both small and large enterprise Malaysia, JomeInvoice has quickly become a standout choice, positioning itself among the Top 3 middleware as e-invoicing platforms in the country. With its user-friendly features and robust system compatibility, it’s no surprise why many businesses are turning to JomeInvoice for a seamless transition to the LHDN’s e-invoicing compliance.

Why JomeInvoice is the Best e-invoicing Software Solution for SMEs and Large Enterprise Malaysia:

JomeInvoice stands out as the most user-friendly and comprehensive e-invoicing software solution, offering the perfect balance of flexibility, compliance, and support for both SMEs and large enterprise Malaysia. Whether you are transitioning into the LHDN e-invoicing mandate or looking to streamline your current invoicing process, JomeInvoice provides everything you need—from free trials to ongoing updates and local support.

- Flexible System Compatibility

JomeInvoice offers seamless integration with popular systems such as SAP ECC6, S4 Hana, Sage300, MS365, Netsuite, Odoo, Xero & etc. This flexibility makes it ideal for businesses of all sizes—whether you’re an SME or a large enterprise Malaysia, JomeInvoice adapts to your current operations without a hitch. - Full Compliance with LHDN e-Invoicing Regulations

Compliance is key, and JomeInvoice ensures that your business meets all LHDN e-invoicing guidelines. ISO-certified and fully PDPA-compliant, JomeInvoice offers a secure, worry-free invoicing process that keeps you aligned with Malaysia’s regulatory standards. - Trusted by Leading Businesses

Over 60+ major companies, including those in Phase 1 of e-invoicing compliance, rely on JomeInvoice for their invoicing needs. The platform is proven to handle large-scale, complex transactions seamlessly, making it a trusted choice across industries. - Free Upgrades, Training, and Dedicated Support

JomeInvoice keeps your business up to date with automatic upgrades that maintain LHDN compliance. Plus, free training and access to a dedicated Malaysian support team ensure your staff can easily adapt to the platform. With cloud server capabilities, you’ll also benefit from secure, flexible invoicing solutions. - Backed by a Listed Company

JomeInvoice is not just reliable but also backed by a publicly listed company on Bursa Malaysia. This adds an extra layer of trust and assurance for businesses looking to invest in long-term solutions.

Ready to streamline your e-invoicing processes?

Contact JomeInvoice today and take advantage of the best e-invoice software features! Our dedicated team is ready to help your business stay ahead with compliance and efficiency.

Contact JomeInvoice Sdn Bhd:

- Address:

Level 38, MYEG Tower, Empire City Damansara, Jalan PJU 8, Damansara Perdana, 47820 Petaling Jaya, Selangor

D-04-07, Plaza Bukit Jalil (Aurora Place), No. 1, Persiaran Jalil 1, Bandar Bukit Jalil, 57000 Kuala Lumpur - Phone: +6016-732 0163

- Social Media:

LinkedIn | Facebook

Don’t wait—schedule a free consultation today and see why JomeInvoice is the top choice for businesses nationwide!