Transactions with Buyers: e-invoicing Malaysia Guidelines for Seller

With the phased implementation of e-invoicing Malaysia, sellers are required to issue e-invoices for all transactions. However, certain buyers may not request an e-invoice. Below are a few scenarios to help sellers better understand the procedures related to different transaction types:

Scenario 1: MSMEs Exempted from Issuing e-invoices

If a seller’s annual revenue falls below RM150,000, they are not required to issue an e-invoice. For example, Tina purchases 50 boxes of kuih from Mak Cik Rosa for a company event. Although Tina requests an e-invoice, Mak Cik Rosa’s revenue is below the RM150,000 threshold, allowing her to issue a handwritten receipt instead. This exemption is in line with the e-invoicing Malaysia guidelines for MSMEs, though they can voluntarily opt for e-invoicing.

Editor Note: e-Invoice regulations may change. This article reflects information available at the time of publication. Based on the latest guidelines issued by the Inland Revenue Board of Malaysia, MSMEs with annual revenue of RM1 million or below are exempt from mandatory e-Invoicing. For the latest updates and timelines, refer to our Latest e-Invoice Updates page.

Scenario 2: Buyers Requesting an e-invoice at the Point of Sale

Buyers, like Tina, may request an e-invoice while purchasing goods. For instance, when she buys a smartphone from Kedai Elektronik Smart Gadget, Bobby, the store owner, collects Tina’s details and submits the e-invoice to LHDNM through his integrated POS system. Once validated, a visual e-invoice with an embedded QR code is provided to Tina.

Scenario 3: Buyers Requesting an e-invoice After the Point of Sale but Within the Same Month

If a buyer forgets to request an e-invoice during the purchase, they can still do so later. For example, Tina returns to Kedai Elektronik Smart Gadget a few days after buying a smartphone to request an e-invoice. Since the request is made within the same month of purchase, Bobby can issue the e-invoice accordingly.

Scenario 4: Buyers Requesting an e-invoice After the Month of Purchase

If the buyer requests an e-invoice after the month of purchase, the seller may refuse, depending on internal policies. In Tina’s case, when she returns in September to request an e-invoice for a smartphone purchased in August, Kedai Elektronik Smart Gadget declines because the August e-invoices have already been submitted.

Scenario 5: Mandatory Information for Malaysian Buyers

When requesting an e-invoice, Malaysian individual buyers like Tina must provide details such as their Tax Identification Number (TIN) or MyKad, along with their name, address, and contact number. Sellers use this information to complete the e-invoice submission via the POS system.

Scenario 6: e-invoicing via MyInvois Portal

Buyers will receive an email notification after their e-invoice is validated. For example, when Tina buys a smartphone, Bobby creates and submits the e-invoice using the MyInvois Portal. Tina will then be notified via email once the submission is validated by LHDNM.

Scenario 7: Batch Upload for e-invoice Submission

If multiple buyers request e-invoices, sellers can use the Batch Upload function via the MyInvois Portal. For instance, Bobby issues e-invoices for Aina, Cass, and Tina by entering their details into an Excel sheet, which is uploaded to the portal for batch submission. They will each receive an email notification once the e-invoices are validated.

Scenario 8: Consolidated e-invoice for Buyers Who Do Not Require e-invoices

If buyers do not request e-invoices, sellers must still submit a consolidated e-invoice to LHDNM by the 7th of the following month. For example, if Aina, Cass, and Tina purchase smartphones on 11 September without requesting e-invoices, Kedai Elektronik Smart Gadget can issue regular receipts and submit a consolidated e-invoice for all non-e-invoice transactions by 7 October.

This guide helps sellers navigate various buyer interactions under Malaysia’s e-invoicing requirements, ensuring compliance while managing different transaction scenarios efficiently.

Statements or Bills on a Periodic Basis: e-invoicing Malaysia Guidelines

In certain business models, it is common to issue periodic statements or bills to record multiple transactions between the seller and the buyer over a specific period. With the implementation of Malaysia’s e-invoicing system, these periodic statements will also be subject to e-invoicing requirements. Sellers are mandated to issue an e-invoice for the items reflected in these periodic statements or bills, covering amounts owed, payments made, and any credits or adjustments applicable.

Below are two Scenarios that explain how e-invoices will be applied for periodic billing:

Scenario 1: e-invoicing for Monthly Statements or Bills

For businesses that issue statements or bills on a regular (e.g., monthly) basis, an e-invoice must be generated for the corresponding charges.

For example, Kenny receives his October phone bill from his telecom provider, Delca Telco Sdn Bhd. When Kenny requests an e-invoice, Delca Telco prepares and submits it to LHDNM via their integrated system. Once validated, a visual representation of the e-invoice is shared with Kenny, allowing him to review the bill and process payment as required. This process is repeated for each billing cycle, ensuring that all charges are e-invoiced in compliance with the e-invoicing framework.

Scenario 2: Adjustments in Periodic Billing (e.g., Rebates)

In cases where adjustments such as rebates or discounts are applied to a buyer’s periodic statement, the seller must include these modifications in the e-invoice.

For instance, Tina has been a long-term subscriber to Delca Telco Sdn Bhd’s postpaid plan, and as a token of appreciation for her loyalty, she receives a RM10 monthly rebate for the next 24 months. When issuing Tina’s e-invoice for her monthly charges, Delca Telco includes the rebate amount along with the regular monthly fee. This allows Tina to see both the total payable amount and the rebate, making the billing process transparent and easy to track.

e-invoicing Malaysia Guidelines for Disbursement or Reimbursement

In business transactions, reimbursements and disbursements are common practices. Reimbursements refer to out-of-pocket expenses that a seller incurs while providing goods or services to a buyer, which the buyer later reimburses. Disbursements, on the other hand, refer to expenses paid by the seller to a third party in connection with the goods or services provided to the buyer.

Under the new e-invoicing Malaysia guidelines, reimbursements and disbursements will also need to be handled within the e-invoicing system. The following Scenarios explain different scenarios for better understanding:

Scenario 1: A Single e-invoice Including Both Service Fees and Reimbursements

When a seller provides goods or services and incurs additional expenses that need to be reimbursed by the buyer, the e-invoice can reflect both the service fee and the reimbursement as separate line items.

For example, Perniagaan Adibah hires an event planner to organize their product launch. The event planner rents a hotel ballroom for RM30,000 and receives an e-invoice from the hotel. When billing Perniagaan Adibah, the event planner issues an e-invoice that includes both the event planning services and the hotel ballroom rental as separate line items. This way, Perniagaan Adibah can clearly see the breakdown of the service fee and the reimbursement for the ballroom rental within a single e-invoice.

Scenario 2: No e-invoice Required for Payments Made on Behalf of a Buyer

In some cases, third-party companies make payments on behalf of the buyer without any direct transaction between the third party and the seller. In these cases, no additional e-invoice is required between the third party and the buyer.

For example, DEF Company hires HR Hiring for recruitment services, and HR Hiring issues an e-invoice to DEF Company for the service fee. However, ABC Company, which is DEF’s parent company, pays HR Hiring on behalf of DEF. Later, DEF Company reimburses ABC Company. In this scenario, no e-invoice is required from ABC Company to DEF, nor from HR Hiring to ABC, since there is no direct transaction between these parties beyond internal payment.

Self-Billed e-invoice: e-invoicing Malaysia Guidelines

Self-billed e-invoices are a specific category of e-invoicing where the buyer issues the invoice rather than the seller. This is applicable in certain situations, such as payments to agents, dealers, distributors, foreign sellers, and more. Below is an explanation of scenarios in which self billing e-invoices must be issued:

When Are Self-Billed e-invoices Required?

Buyers are required to issue self billing e-invoices in the following situations:

- Payments to agents, dealers, and distributors.

- Goods sold or services rendered by foreign sellers.

- Profit distribution.

- E-commerce transactions.

- Pay-outs to betting and gaming winners.

- Acquisition of goods or services from individual taxpayers.

- Interest payments, except for financial institutions or specific cases like interest from employees to employers or from foreign payors to Malaysian taxpayers.

- Claims, compensation, or benefit payments from the insurance business of an insurer.

Self-Billed e-invoices:

Scenario 1: Self-Billed e-invoice for an Individual Selling Non-Business Goods

Tina, an individual who is not conducting a business, sells one of her teddy bears to Kedai Permainan Cuddle Bears, a company that buys and sells used toys. Since Tina is not conducting a business, she is not required to issue an e-invoice. Instead, Kedai Permainan Cuddle Bears must create and submit a self billing e-invoice to record the expense for the purchase.

Scenario 2: Self-Billed e-invoice for Business Tenants Paying Rent to Non-Business Landlords

Tina, an individual who does not conduct a business, rents her commercial shoplot to Kedai Elektronik Smart Gadget. Since Tina is not conducting a business, she is not required to issue an e-invoice for rental or utility bills. In this case, Kedai Elektronik Smart Gadget must create and submit a self billing e-invoice for these payments, recording them under Tina’s name.

Scenario 3: Self-Billed e-invoice for Multiple Landlords

If a business rents from multiple landlords who are not conducting a business, such as Best Mesra Sdn Bhd, which rents office space from three brothers—Haikal, Alif, and Arif, the company must create and submit separate self billing e-invoices for each landlord based on their agreed-upon rental proportions.

Scenario 4: No Self-Billed e-invoice Required for Interest Payments to Financial Institutions

Tina secures a loan from Bank Duit to finance her car purchase. Since Bank Duit is a financial institution, Tina is not required to issue a self billing e-invoice for her monthly interest payments. Instead, Bank Duit will issue the standard e-invoice for her payment.

Scenario 5: Self-Billed e-invoice for Interest Payments to Related Companies

When Kedai Elektronik Smart Gadget obtains a RM1 million loan from its holding company, SMART Sdn Bhd, and SMART charges interest on this loan, Kedai Elektronik Smart Gadget must create and submit a self billing e-invoice for the interest paid to SMART.

e-invoicing Malaysia Guidelines for Seller: When Making Payments to Agents, Dealers, and Distributors (ADD)

In supply chains, agents, dealers, and distributors often receive commissions or other forms of payments. For these transactions, the seller making the payments is required to issue a self billing e-invoice under Section 83A of the Income Tax Act 1967.

Scenario 6: Self-Billed e-invoice for Commission Payments to Agents

Alif, a car salesman at Bond Automotive Sdn Bhd, sells a car for RM600,000 and earns a 20% commission. In this case, Bond Automotive must issue a self billing e-invoice to record the commission paid to Alif.

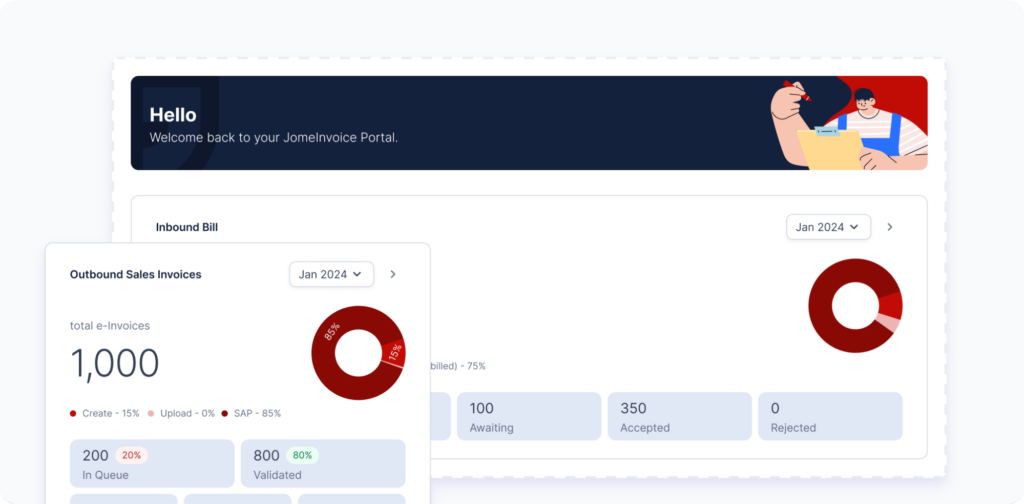

Explore Top 3 e-invoicing Middleware Solutions in Malaysia: Why JomeInvoice is the Best Choice

JomeInvoice Top 3 e-invoicing Software Malaysia

When it comes to e-invoicing software Malaysia, JomeInvoice stands out as one of the Top 3 e-invoicing middleware solutions trusted by businesses nationwide.

Here’s why JomeInvoice’s e-invoicing software should be your top choice for ensuring a smooth, compliant transition to the LHDN’s e-invoicing requirements:

- Flexible System Compatibility for SME and Enterprise Malaysia: JomeInvoice integrates effortlessly with various systems like SAP ECC6, S4 Hana, Sage300, MS365, Netsuite, Odoo, Xero & etc, providing unparalleled flexibility for businesses of all sizes.

- Full LHDN e invoice-compliant: JomeInvoice is ISO certified and PDPA compliant, adhering to the highest standards of data protection and security. Your invoicing process is secure, and your business remains fully compliant with LHDN e-invoicing Malaysia guidelines / regulations.

- Trusted by Leading Businesses: Over 60+ Phase 1 companies rely on JomeInvoice to manage their e-Invoicing, ensuring seamless and accurate transactions.

- Free Upgrades and Training: Get continuous support with free upgrades to stay LHDN-compliant, alongside free training, a cloud server, and customer support from a dedicated Malaysian team.

- Listed Company: JomeInvoice is backed by a company listed on Bursa Malaysia.

Contact Us Today and Streamline Your e-invoicing with JomeInvoice

Take the first step towards hassle-free e-invoicing compliance with JomeInvoice! Our dedicated Malaysian team is here to assist you in ensuring that your business stays ahead of the curve.

Contact JomeInvoice Sdn Bhd:

- Address:

- Level 38, MYEG Tower, Empire City Damansara, Jalan PJU 8, Damansara Perdana, 47820 Petaling Jaya, Selangor

- D-04-07, Plaza Bukit Jalil (Aurora Place) No 1, Persiaran Jalil 1, Bandar Bukit Jalil, 57000 Kuala Lumpur

- Phone: +6016-732 0163

Find Us on Social Media:

- LinkedIn: JomeInvoice LinkedIn

- Facebook: JomeInvoice Facebook

Ready to Get Started?

Contact us now to schedule a free consultation and learn how JomeInvoice can simplify your e-invoicing processes. Experience our best e-invoice software features, and let us handle your compliance needs with ease!

Source: LHDN e invoice Guideline – Last Updated on 11 September 2024